-

Gusto: Best overall ADP competitor

-

Papaya Global: Best for global workforce management

-

QuickBooks: Best for current QuickBooks users

-

Paycor: Best for custom configurations

-

OnPay: Best for simplifying complex payroll processes

Automatic Data Processing Inc. is a leading provider of comprehensive payroll, human capital management, benefits management and business process outsourcing solutions. Founded in 1949, ADP is one of the most established players in the HCM space, offering a wide range of services to help businesses manage their most essential resource: their people. With a presence in more than 140 countries, ADP is one of the largest HCM providers in the world.

SEE: Payroll processing checklist (TechRepublic Premium)

ADP serves more than one million clients worldwide, including small, mid-sized and large businesses. As the industry continues to evolve, so too does the competition, with a number of alternatives emerging to challenge ADP’s market share.

There are several alternative solutions available with similar features and capabilities as ADP. In this analysis of ADP competitors, we’ll assess their core services, features and capabilities, customer experience and pricing strategy to identify the leading ADP alternatives in the market and what differentiates them.

Jump to:

- Top ADP competitors and alternatives: Comparison table

- Top ADP competitors

- Is ADP worth it?

- ADP pros & cons

- Do you need an alternative to ADP?

Top ADP competitors and alternatives: Comparison table

Top ADP competitors

This list provides a brief overview of some of the top competitors and alternatives for ADP. We’ll cover products and services, features and pricing to help you decide which alternative is best for your business.

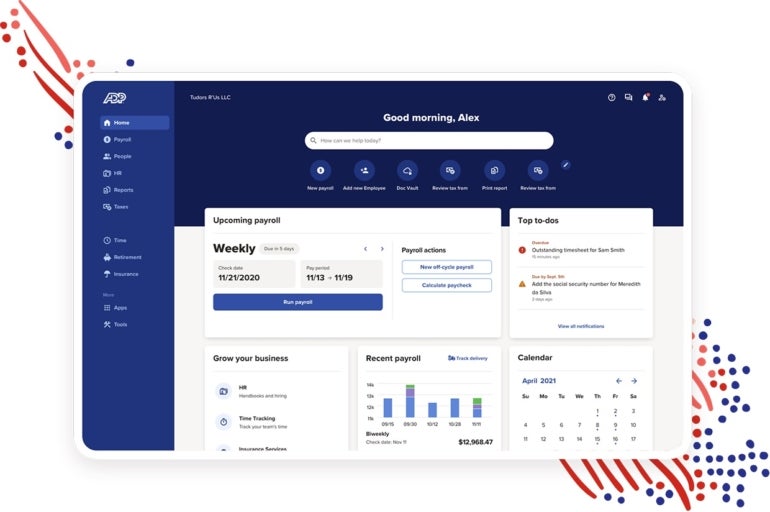

Gusto: Best overall ADP competitor

Gusto is an online payroll, benefits and HR platform that automates employee information management, taxes and payroll. It is a top competitor of ADP, offering a similar suite of services to small and medium-sized businesses, including automated payroll processing, time tracking and electronic onboarding. Gusto is one of the fastest-growing payroll providers in the industry.

Gusto is quickly becoming a popular choice for businesses that want an easy-to-use and affordable payroll solution. Unlike ADP, Gusto files and pays federal, state and local taxes, and it automatically generates and sends W-2s and 1099s to employees and contractors at no extra cost. Gusto also offers free setup and migration for new users, unlike ADP, which charges a setup fee.

Gusto offers three different affordably priced plans depending on your specific needs, starting at $40 per month plus $6 per month per employee for the Simple plan. Pricing increases to $60 per month for the Plus plan plus $9 per month per employee while the Premium plan’s pricing information is available upon request.

Key features of Gusto

- Highly customizable

- Full-service payroll migration and account setup

- Full-service multi-state payroll, including W-2s and 1099s

- Contractor-only plan option

Use cases

- Contracted employee payroll management: It’s ideal for small businesses with contractor employees.

- Payroll management for startups and small businesses: Its unlimited pay runs at no extra fee make this tool useful for startups or small businesses that are making multiple payments monthly.

- Customize to your own use case: Gusto services are highly customizable depending on your requirements.

Feature graph

| Features | ADP | Gusto |

|---|---|---|

| Promotional offer | Free for the first three months | Offers demo |

| Mobile app | Yes | Yes |

| 24/7 customer support | Yes | No |

| Direct deposit | Yes | Yes |

| PEO option | Yes | No |

| Employee portal | Lifetime access to see pay stubs, W-2s and hours worked | Payment history and up to three years of W-2s/1099s |

| Health insurance benefits | Yes | Yes (Available in 35+ states) |

| Contractor-only pricing | No | Yes |

| Integrations | Third-party integrations with Wave, Xero, Intuit Quickbooks, Sage, Workday and Docufree | Integrates with QuickBooks, Xero, FreshBooks, Clover, Shopify, Sage Accounting and JazzHR |

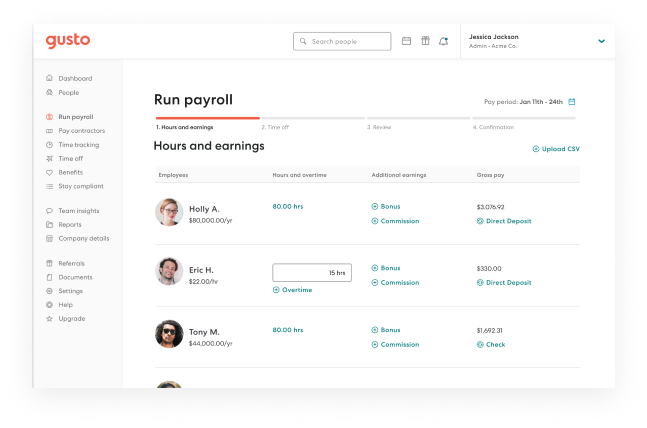

Papaya Global: Best for global workforce management

Papaya Global is a leading global payroll and workforce management platform, providing businesses of all sizes with the tools and services they need to manage a global workforce. The platform offers a comprehensive suite of solutions, designed to help companies manage payroll, taxes, benefits, compliance and more in over 160 countries.

With Papaya, businesses can accurately pay their employees, manage taxes and comply with local regulations, minimizing the burden of global payroll. Papaya Global’s services are designed to simplify the complexities of global payroll and HR operations, allowing companies to focus on their core business.

Papaya Global offers pricing plans that vary depending on the customer’s specific needs. The cost of the plans is based on the number of employees and services the customer requires. Papaya Global offers three pricing plans for its services:

- Global Payroll & Payments: Starting at $20 per month per employee

- Employer of Record: Starting at $770 per month per employee

- Contractor Management: Starting at $25 per month per contractor

Key features of Papaya Global

- HR and payroll features that cover onboarding, payroll, benefits, taxes, insurance and compliance

- Catered solutions for 160+ countries

- Automated payroll processing

- Compliance with local labor laws

- Secure storage

Use cases

- Global payroll: This tool is great for streamlining payroll operations for businesses with employees all over the world, including for cross-border and cross-currency payments.

- Contracted employee payroll management: Payment tracking and progress monitoring features are specially designed to work well with contractor-based workforces.

- International HR and compliance management: Papaya Global offers a strong backbone for other international HR tasks, especially with automated global compliance features.

Feature graph

| Features | ADP | Papaya Global |

|---|---|---|

| Promotional offer | Free for the first three months | No |

| Presence | 140+ countries | 160+ countries |

| Customer base | Over 1 million | 700 plus |

| Applicant tracking | Yes | Yes |

| Attendance tracking | Yes | Yes |

| Onboarding | Yes | Yes |

| Employee portal | Yes | Yes |

| Mobile app | Yes | Yes |

| HR tools | Yes | Yes |

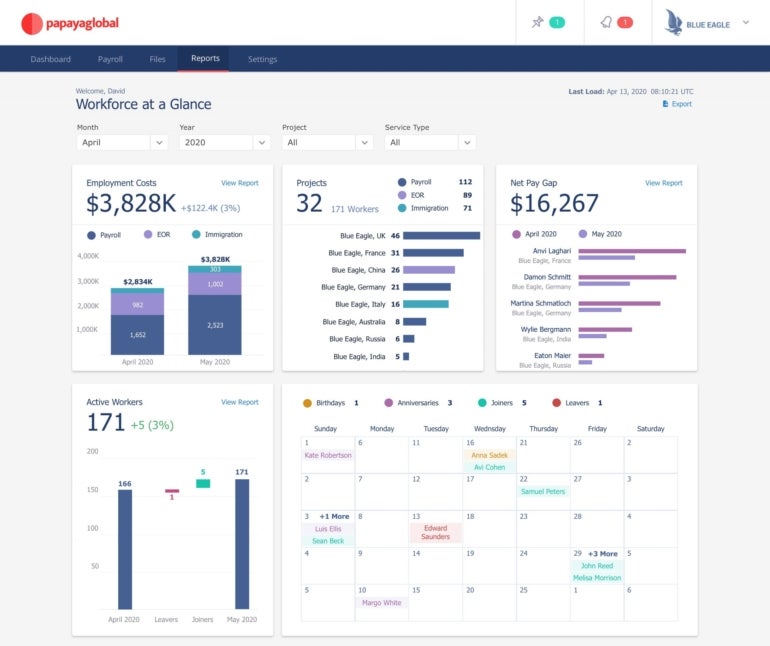

QuickBooks: Best for current QuickBooks users

QuickBooks is one of the most popular accounting software solutions for small businesses. It is a comprehensive, cloud-based accounting option that offers features such as invoicing, payroll, accounts receivable, accounts payable and bank reconciliation. It also provides tools for tracking expenses, managing taxes and managing inventory. QuickBooks is a great alternative to ADP for small businesses that want an easy-to-use accounting solution.

Intuit QuickBooks Payroll offers three main pricing plans:

- Core: $22.50 per month plus $5 per employee per month

- Premium: $37.50 per month plus $8 per employee per month

- Elite: $62.50 per month plus $10 per employee per month.

Additionally, QuickBooks has an ongoing 50% discount on the base price for the first three months.

Key features of QuickBooks

- Automated bookkeeping

- Multi-currency support for global payroll

- Inventory management for stock levels and purchase orders

- Tax preparation support

- Electronic and online Invoicing and billing

Use cases

- Small-business finance and accounting: QuickBooks allows small business owners to track their finances by creating invoices, managing expenses and tracking sales and profits.

- Small-business payroll: QuickBooks helps small business owners manage payroll by allowing them to pay employees, track payroll taxes and generate accurate payroll reports.

- Small-business inventory management: QuickBooks helps small business owners manage their inventory by tracking stock levels, setting reorder points and generating reports on inventory costs and sales.

Feature graph

| Features | ADP | QuickBooks |

|---|---|---|

| Tax filing | Yes | Yes |

| Standard direct deposit | 2-day | Next-day (same-day available in premium and elite plans) |

| Benefits administration | Yes | Yes |

| Inventory management | No | Yes |

| PEO option | Yes | No |

| Advanced HR tools | Yes | No |

| Integrations | Integrates with other accounting solutions | Integrates seamlessly with QuickBooks accounting |

| Auto payroll | Yes | Yes |

| 24/7 support | Yes | Five days a week: Mondays - Fridays |

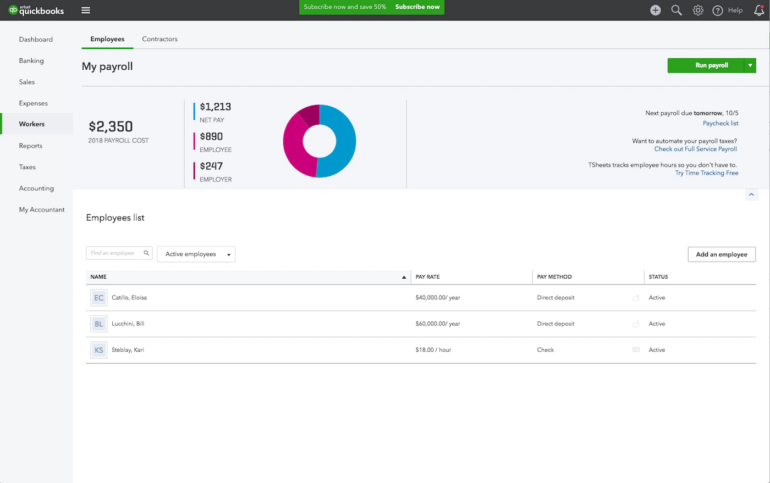

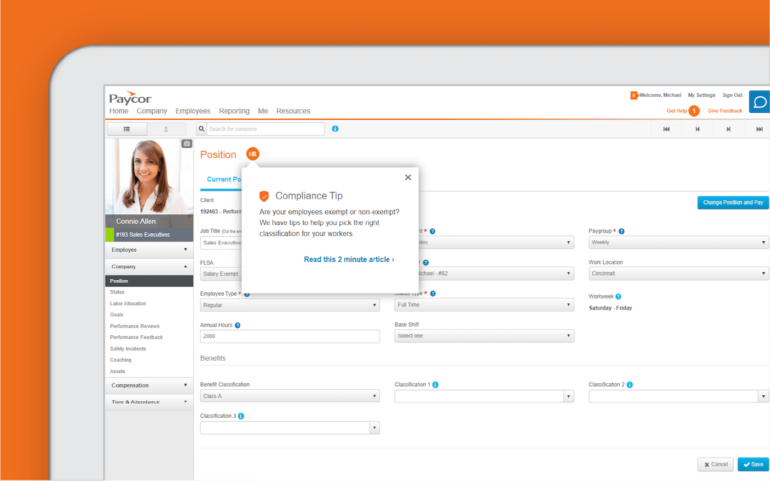

Paycor: Best for custom configurations

Paycor is a leading provider of cloud-based software solutions that help businesses manage human capital. They offer a wide range of HR, payroll and talent management solutions to simplify and streamline how businesses manage their workforces.

Paycor’s solutions are tailored to meet the specific needs of each business; they offer a variety of features, such as payroll processing, tax filing, employee onboarding, and time and attendance tracking. They also offer comprehensive reporting, analytics and a mobile app to access their solutions easily.

Paycor offers four pricing plans for small businesses, ranging from Basic to Complete. The Basic plan starts at $99 per month, plus $5 per employee per month. The Essential plan costs $149 per month, plus $7 per employee per month. The Core plan is priced at $199 per month, plus $8 per employee per month. The Complete plan is $199 per month, plus $14 per employee per month.

Key features of Paycor

- Customizable payroll, HR, time and attendance, recruiting and onboarding solutions

- Web and mobile app accessibility

- Employee self-service portal

- Comprehensive reporting functions

- 256-bit TLS 1.2 data encryption, MFA, IP filtering and other data security measures

Use cases

- Performance management: Paycor can help employers track employee performance and develop strategies for improvement and compensation. This can include setting goals, tracking progress and rewarding performance.

- Talent and recruitment management: Talent management tasks like recruitment, onboarding, compensation management and continuous talent development work are all possible in Paycor.

- Employee experience and engagement management: Paycor can be used to enhance the employee experience, with features such as pulse surveys, sentiment analysis and a built-in learning management system.

Feature graph

| Features | ADP | Paycor |

|---|---|---|

| Promotional offer | Free for three months | Waive 50% on monthly fees for one year for small businesses; three months free for larger organizations |

| Tax filing | Yes | Yes |

| Integrations | Integrates with Jobvite, iCIMS, Performance Pro and Iconixx | Integrates with Employee Navigator, HIRETech, Ascensus, Principal and bswift |

| Benefits administration | Yes | Yes |

| Deployment | Web, cloud, SaaS, Android and iOS | Web, cloud, SaaS, Android and iOS |

| Ease of use | Less so | Yes |

| Self-service portal | Yes | Yes |

| Years of experience | Over 70 years | Over 30 years |

| LMS | Yes | Yes |

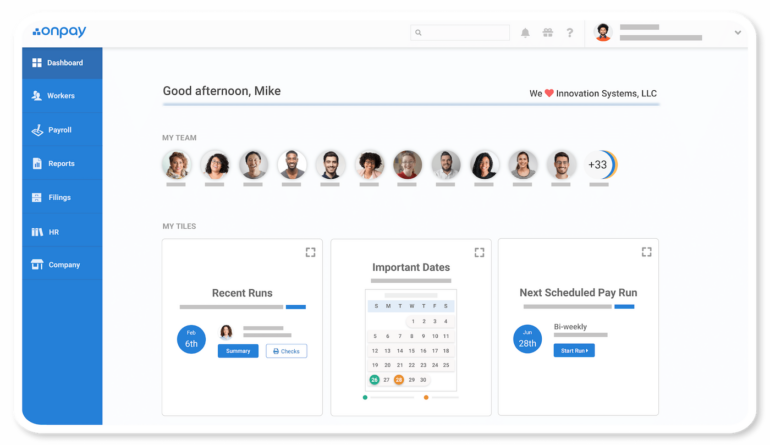

OnPay: Best for simplifying complex payroll processes

OnPay is a cloud-based HR and payroll service that helps small and mid-sized businesses manage payroll and benefits. OnPay provides tools for setting up payroll, tracking time and running reports. It also allows businesses to pay employees by adding funds directly to workers’ pay cards, direct deposit or paper check.

The platform can be integrated with other accounting and HR software. OnPay offers comprehensive services such as tax filing, employee onboarding and employee benefits. The platform also has a wide range of features geared toward helping businesses manage their payroll and benefits, such as custom rules and reporting, payroll tax compliance and onboarding tools.

OnPay is an ideal alternative to ADP for businesses looking to simplify complicated payroll processes. The OnPay monthly base fee is $40 per month, plus $6 per employee per month. The fee includes payroll processing, direct deposit and tax filing.

Key features of OnPay

- Automated, recurring payroll

- Tax filing for federal, state and local taxes

- Tax filing for 1099 contractors automatically

- Employee onboarding forms, access to employee self-service and direct deposit setup

- Various reports and analytics metrics

Use cases

- Unemployment management: OnPay is helpful for unemployment insurance withholding.

- Benefits management: OnPay helps employers manage their employee benefit plans, including tracking deductions, administering changes and calculating payouts.

- Customized payroll reporting: OnPay provides detailed payroll reports with customizable filters, showing employers a full view of their payroll expenses.

Feature graph

| Features | ADP | OnPay |

|---|---|---|

| Promotional offer | Free for three months | One-month free trial |

| Tax filing | Yes | Yes |

| Unlimited pay runs | Yes (costs extra) | Yes |

| Multi-state payroll | Yes (costs extra) | Yes |

| Accounting and time tracking integrations | Yes | Yes |

| Self-service portal | Yes | Yes |

| Benefits and compliance management | Yes (costs extra) | Yes |

| 24/7 support | Yes | No live support on weekends |

| Multiple pay rates and schedules | Yes | Yes |

Is ADP worth it?

ADP is worth it for businesses looking for a comprehensive suite of payroll, HR and benefits solutions. It offers various features, including payroll processing, time and attendance tracking, tax filing and employee benefits management.

The platform is scalable, and its extensive features make it a great choice for businesses of all sizes. They also offer 24/7 support to boost issue resolution time. ADP is particularly well-suited for businesses that need a comprehensive payroll and HR solution and those that want to outsource their payroll and HR operations.

ADP pros and cons

ADP’s features, flexibility and scalability make it an attractive choice for many organizations. However, ADP has some pros and cons that you should consider before making a decision.

ADP pros

- Streamlines payroll processes, making paying employees quickly and accurately easier.

- Automates time and attendance tracking, allowing managers to monitor employee hours worked.

- Provides employee self-service options, enabling employees to access their own payroll and benefits information.

- Offers various payroll and HR services, including the ability to file taxes and manage employee benefits.

- Offers employer-specific payroll and HR services, such as employee onboarding.

- Integrates with other software such as accounting and HR systems for easier data sharing.

- ADP keeps businesses compliant with various federal and state laws, such as those related to payroll taxes and employee benefits.

- ADP offers customer support that is available 24/7 so businesses can get help when they need it.

ADP cons

- The system can be expensive, depending on what features and services are purchased, especially for smaller businesses.

- No transparent pricing.

- The system can be difficult to learn and requires specialized knowledge to get the most out of it.

- Some users have reported difficulties in navigating the user interface

Do you need an alternative to ADP?

ADP offers robust and comprehensive solutions for businesses of all sizes, but there are a few potential drawbacks. Some users have found that ADP’s user interface can be a bit cumbersome and difficult to learn. Additionally, some of ADP’s features come with a steep price tag, making it difficult for smaller businesses or startups to take advantage of them.

SEE: Payroll processing checklist (TechRepublic Premium)

Fortunately, there are several alternatives to ADP that offer similar features but with more user-friendly interfaces and better pricing structures. Before you select your preferred payroll processing software or service, be sure to consider your budget, your internal team’s skill sets, and any industry-specific compliance or security requirements that you need to abide by.

Read next: Top payroll processing services for small businesses (TechRepublic)