Square Payroll and Paychex are two prominent payroll software solutions that cater to different business needs. Square Payroll is known for its simplicity and seamless integration with Square’s ecosystem, making it an ideal choice for small businesses. On the other hand, Paychex is characterized by its extensive HR and payroll features that have served small to midsize businesses for years.

In this article, we compare Square Payroll and Paychex in terms of features, pricing, pros and cons to help you make the best choice for your business.

Jump to:

- Square Payroll vs. Paychex: Comparison table

- Square Payroll and Paychex: Pricing

- Feature comparison: Square Payroll vs. Paychex

- Square Payroll pros and cons

- Paychex pros and cons

- Methodology

- Should your organization use Square Payroll or Paychex?

Square Payroll vs. Paychex: Comparison table

| Features | Square Payroll | Paychex |

|---|---|---|

| Payroll processing | Yes | Yes |

| HR management | Limited | Extensive |

| Tax compliance | Yes | Yes |

| Time tracking | Yes | Yes |

| Pricing per month | Starting at $6.00/employee | Starting at $39.00 base fee + $5.00/employee |

Square Payroll and Paychex: Pricing

Square Payroll offers a simple pricing structure with a base fee of $35 per month plus $6 per employee per month. This pricing structure makes Square Payroll particularly attractive for small businesses with a limited number of employees. It allows for better cost predictability since the monthly fee is fixed and the per-employee cost is clearly defined.

On the other hand, Paychex provides specific pricing for one of its plans and custom quotes for its higher-tier plans, based on the unique needs of each business.

Paychex Flex Essentials costs $39 per month plus $5 per employee per month. Paychex Flex Select and Paychex Flex Pro can each be customized for your specific business requirements. While this provides an opportunity for businesses to tailor the solution to their specific wants and needs, it can also make it challenging to compare costs with other providers or estimate expenses without obtaining a quote.

Be wary of hidden costs that may arise from any of these products. Square Payroll states that their pricing plans include everything and have no hidden fees, but it doesn’t hurt to double-check.

For a greater analysis of each product’s pricing and features, read our Square Payroll and Paychex product reviews.

Feature comparison: Square Payroll vs. Paychex

Square Payroll and Paychex offer a range of features to streamline payroll processes and meet the needs of businesses. Let’s explore the key features provided by each solution and how they differ.

Payroll processing

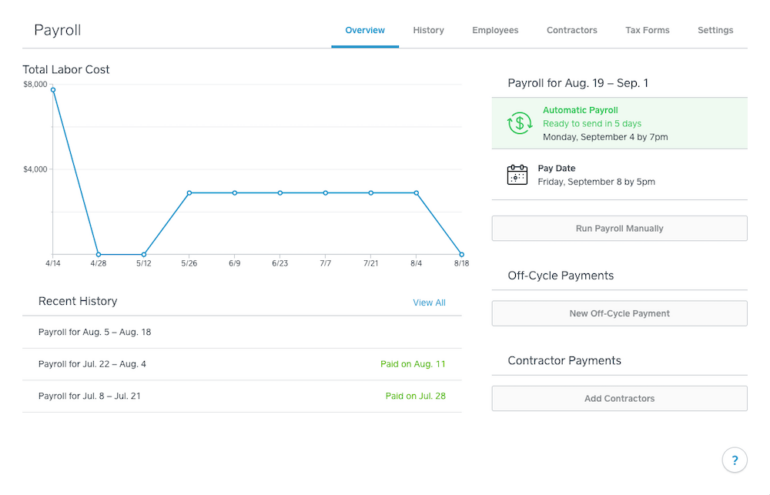

Square Payroll simplifies payroll processing (Figure A) with its user-friendly interface and intuitive workflow. The platform automatically calculates wages, taxes and deductions, streamlining the payroll process for businesses.

It also generates pay stubs and facilitates direct deposits, ensuring timely and accurate payments to employees. Square Payroll is designed to be accessible and easy to navigate, making it ideal for small to medium-sized businesses.

Figure A

Paychex, on the other hand, provides a comprehensive suite of payroll services. It offers robust payroll processing capabilities, including tax filing and reporting. Paychex also has extensive expertise in federal, state and local tax regulations, ensuring compliance and minimizing the risk of errors. The platform caters to businesses of all sizes and offers scalability as companies grow and their payroll needs evolve.

HR management

Because Square Payroll focuses primarily on payroll, it has limited HR management functionalities compared to Paychex. It provides essential HR features such as employee onboarding and access to employee data, but it doesn’t offer the same level of depth and customization as Paychex.

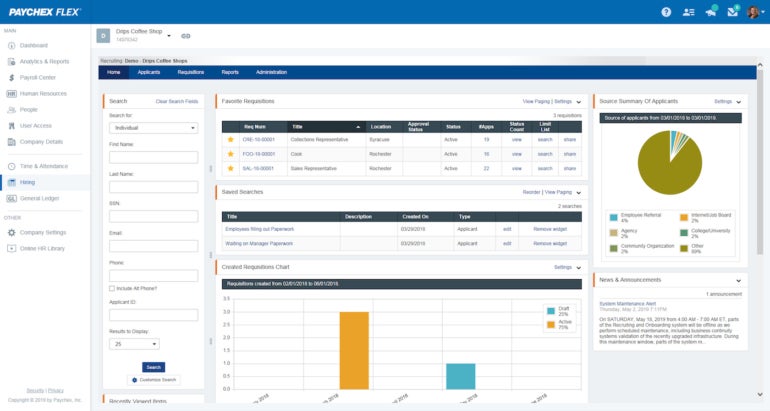

Figure B

Paychex offers a comprehensive suite of HR features, including performance management, employee engagement tools, recruiting features (Figure B) and onboarding functionalities. Paychex’s HR management features allow businesses to streamline HR processes, improve employee performance and effectively manage the employee lifecycle.

Tax compliance

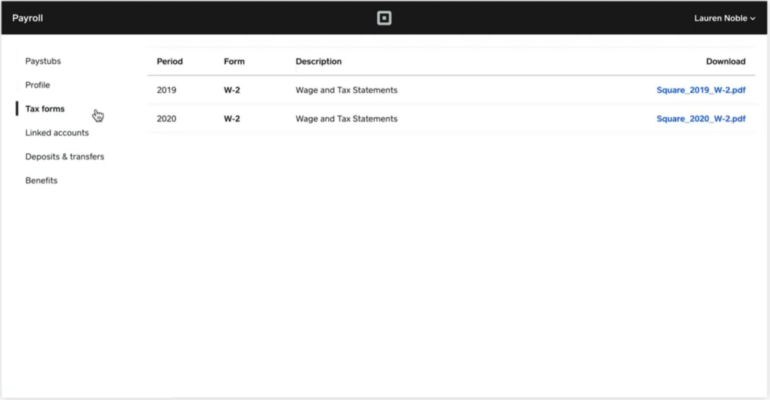

Both Square Payroll and Paychex prioritize tax compliance to ensure businesses meet their obligations. Square Payroll calculates and withholds taxes accurately, generating tax forms (Figure C) and facilitating tax filings, which simplifies the complexities of tax compliance and reduces the administrative burden for businesses.

Figure C

Paychex, with its team’s extensive experience and knowledge of tax regulations, offers a robust tax compliance system. It stays updated on ever-changing tax laws and regulations, ensuring accurate tax calculations, timely filings and adherence to compliance requirements. Paychex provides a comprehensive suite of additional tax services, including federal, state and local tax management and expert business support and guidance.

Time and attendance

Square Payroll offers basic time tracking features to monitor employee attendance and work hours. Employees can clock in and out using different methods, and managers can track and approve timesheets. However, it does have limited time and attendance features compared to Paychex.

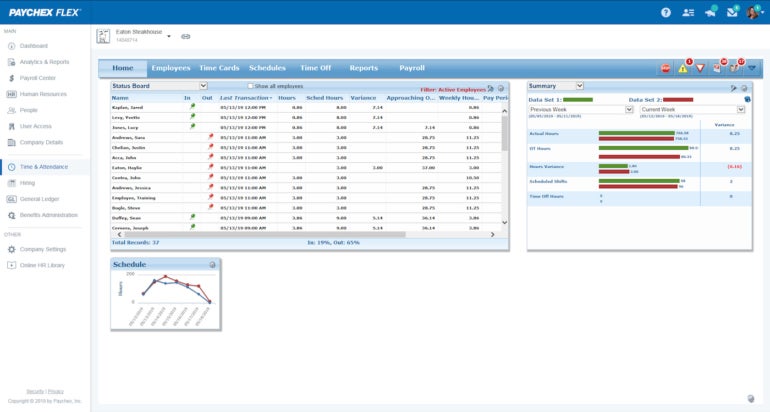

Figure D

Paychex offers robust time and attendance features (Figure D). Along with clocking in and out, it has advanced functionalities for scheduling, overtime tracking and labor distribution reports. Paychex’s time and attendance tools offer comprehensive insights into employee work hours and help businesses manage labor costs effectively.

Square Payroll pros and cons

Pros of Square Payroll

- User-friendly interface and easy navigation, suitable for businesses with minimal payroll expertise.

- Seamless integration with Square’s ecosystem, enabling a unified experience for small businesses using Square POS.

- Competitive pricing plans are transparent and straightforward, making it cost-effective for small businesses.

Cons of Square Payroll

- Limited HR management functionalities, which may not meet the needs of businesses with complex HR requirements.

- A standardized payroll solution with leaner customization options, which could hinder businesses with unique payroll requirements.

Paychex pros and cons

Pros of Paychex

- Extensive HR and payroll features cater to a wide range of business needs, offering an all-in-one solution for workforce management.

- Comprehensive HR management streamlines HR processes and supports the entire employee lifecycle.

- Customizable solutions can adapt to changing payroll and HR needs for businesses of all sizes.

Cons of Paychex

- Custom pricing structure makes it difficult to compare costs with alternatives or estimate expenses without getting a quote.

- Steeper learning curve with robust features and functionalities, which may not be worth it for small businesses with simpler payroll needs.

Methodology

To provide an accurate comparison, we based our research on the features, pricing, pros and cons of Square Payroll and Paychex. Customer reviews and official product documentation largely informed our findings.

Should your organization use Square Payroll or Paychex?

The choice between Square Payroll and Paychex depends on your organization’s specific requirements. If you’re a small business looking for a simple and affordable payroll solution with seamless integration, Square Payroll might be the right fit for you.

But if you need comprehensive HR management features alongside payroll processing, Paychex offers a robust solution. Just be sure to carefully consider your business size, needs and budget to make an informed decision.

Read next: Choosing a payroll service: A guide for business leaders (TechRepublic Premium)