-

Intuit QuickBooks: Best for quick direct deposit

-

Gusto: Best for contractor-only businesses

-

Paychex: Best for human resources management features

-

ADP: Best for complex business models

-

OnPay: Best payroll processing for small businesses

-

Rippling: Best for consolidating HR, IT and finance business functions

-

Justworks: Best for professional employer organization model

-

Paycor: Best for reporting and analytics

-

SurePayroll: Best for DIY and affordability

-

Remote: Best for distributed teams

Small businesses must often work with lesser pools of resources than their larger counterparts, especially due to smaller working budgets and teams. Fortunately, the right technology makes it much easier for small business owners to manage their companies at a fraction of the cost of big corporations. In many cases, the “right” technology is still within budget and scope for small businesses.

SEE: Payroll processing checklist (TechRepublic Premium)

Jump to:

- Best payroll software for small businesses

- What is payroll software?

- Key features for payroll software solutions

- Benefits of working with payroll software

- How do I choose the best payroll software for my small business?

Best payroll software for small businesses

The software you choose for your small business can significantly impact its operations and financial health. As such, the best payroll software for your small business should be simple, cost-effective and scalable, so it can grow with your business. These are some of the best payroll solutions that meet these requirements for small businesses.

Intuit QuickBooks: Best for quick direct deposit

QuickBooks Payroll is a cloud-based payroll solution from Intuit that is designed to help small and medium-sized businesses manage their employee pay and tax obligations. It provides small businesses with a cost-effective way to manage payroll.

With an intuitive user interface that’s easy to navigate, it integrates seamlessly with other QuickBooks products to get the complete picture of your business’s finances. Although QuickBooks Payroll can be used as a stand-alone product without using any of Intuit’s other accounting programs, there are additional benefits for users who combine QuickBooks Online Accounting with QuickBooks Payroll.

Features

- Auto-run payroll for all eligible employees

- Garnishments and deductions management

- Easy-to-create and download documentation, including payroll history, bank transactions, contractor payments, paid time off and tax reports

- Health benefits and 401(k) plans available

Pros

- Fast payment deposit

- Tax penalty protection of up to $25,000

- Automated tax payments and filing

- Full-service payroll available with all plans

Cons

- No time tracking feature in the core plan

- Can be expensive for companies with high employee headcount

Pricing

Intuit QuickBooks offers three main pricing plans:

- Core: $37.50 per month, plus $5 per employee per month

- Premium: $50 per month, plus $5 per employee per month

- Elite: $80 per month, plus $8 per employee per month

Additionally, QuickBooks has an ongoing promotion offer of 50% off the base price for the first three months.

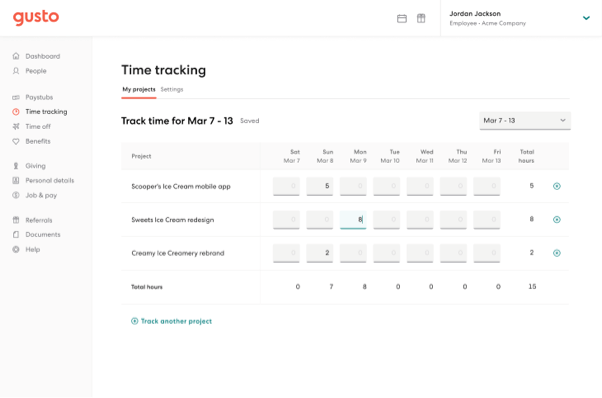

Gusto: Best for contractor-only businesses

Gusto is a leading full-service payroll provider with payroll software designed specifically for small businesses. This tool automates both basic and more advanced payroll tasks for employees and contractors easily and without extra work required of business owners.

They also offer benefits like disability insurance coverage and dental insurance for your employees, which can be tailored to suit your needs and budget. In addition, Gusto is designed to handle most small businesses’ HR-related needs, including tax filing and reporting requirements, time tracking, expense tracking, scheduling shifts, and employee onboarding.

Features

- Cross-border payment capabilities for international contractors in over 95 countries

- Unlimited payroll runs per month

- Gusto Wallet app helps employees track, save and access their money

- Support for employees to open a spending account with a debit card included

- Lifetime employee access to digital pay stubs and W-2s in their Gusto accounts

Pros

- A contractor-only plan is available

- Appealing user interface

- Easy onboarding of contractors and W-2 employees

- Positively-reviewed customer service and support

Cons

- Direct deposit may take two to four days

- The simple plan isn’t feature-rich

Pricing

Gusto is priced affordably, depending on your specific needs:

- Simple plan: Starts at $40 per month, plus $6 per month per employee

- Plus plan: Starts at $80 per month, plus $12 per month per employee. Users can currently save 25% for six months.

- Premium plan: Pricing for this plan is available upon request

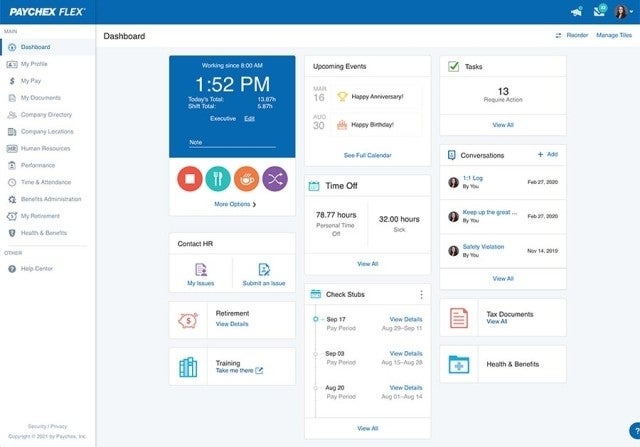

Paychex: Best for human resources management features

Paychex is a leading human capital management provider that offers a range of products and services to meet HR department needs. With payroll, benefits, workers’ compensation, insurance administration and compliance, and talent acquisition solutions, Paychex provides small business owners with the resources they need to manage their employees more effectively.

Paychex is ideal for small businesses that are growing rapidly or those that want an easy-to-use platform they can access from anywhere. Paychex can manage over 1,000 employees’ payroll and also comes with a mobile app option.

Features

- Used to calculate, file and submit payroll taxes

- Support for hiring, onboarding and managing new employees

- Paychex Voice Assist for secure and hands-free payroll processing support

- Time and attendance tracking capabilities

- Federal, state and local payroll tax management

Pros

- Mobile app available

- Resource center for users

- Intuitive self-service portal and other features

- Auto deductions and remittance to the appropriate agencies

Cons

- Support can be improved

- Some users infrequently experience software glitches

Pricing

There are three different plans to choose from with Paychex:

- Paychex Flex Essentials: $39 per month, plus $5 per employee

- Paychex Flex Select: Pricing information available upon request

- Paychex Flex Pro: Pricing information available upon request

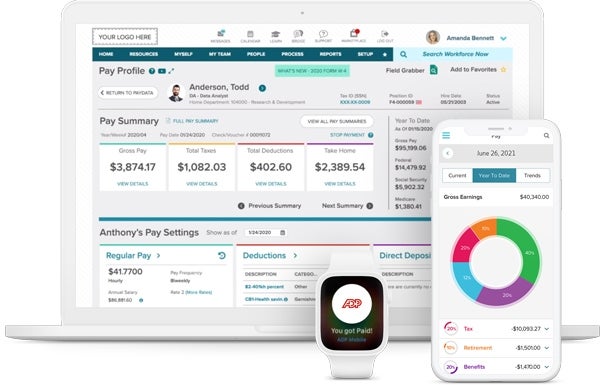

ADP: Best for complex business models

ADP is a leading cloud-based HCM service provider that offers HR, payroll, talent, time, tax and benefits administration. Founded in 1949, ADP is one of the largest payroll processors in the U.S., serving over 920,000 clients. ADP has a longstanding history of providing innovative solutions that help small businesses better manage their payroll and automate back-office tasks such as compliance reporting, tax payments and benefits management.

ADP automatically creates and sends W-2 and 1099 forms to your employees and contractors, so you can focus on running your business. Businesses in complex industries like construction or manufacturing need additional features like these, as well as timekeeping and scheduling, that aren’t available in many other payroll software packages.

For these businesses, it’s essential to find an HR software system that also offers robust features related to workforce management, such as automated timekeeping, schedule building and shift management tools. As your company grows or diversifies into new markets with different labor laws, regulations or benefit requirements, ADP provides the flexibility to accommodate these new requirements.

Features

- Reporting capabilities for viewing, accessing, customizing and printing payroll and HR reports online

- State unemployment insurance management features

- Employee handbook wizard for handbook design based on federal employment law

- Payroll debit cards and multi-state payroll in all plan levels

- Labor law poster compliance

Pros

- Offers features and package levels for businesses of all sizes

- Integrates with over 100 other tools

- User-friendly and easy to navigate

- All plans come with onboarding assistance

- Same-day direct deposit

Cons

- Not transparent with pricing

- The user interface could be improved

Pricing

Pricing is an essential factor to consider when choosing a payroll provider. ADP offers four payroll plans that allow you to find the one that’s right for your company’s size and needs. Pricing information is only available upon request from the ADP sales team.

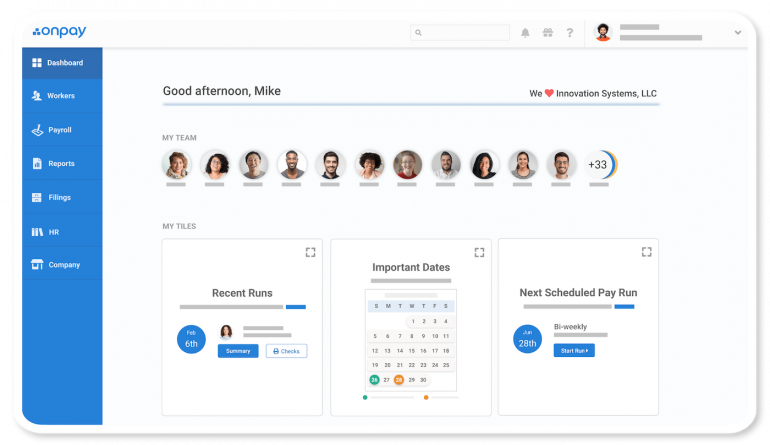

OnPay: Best payroll processing for small businesses

OnPay is a cloud-based full-service payroll processing system with everything from payroll to benefits administration and tax filing.

OnPay automatically runs payroll based on a preset schedule, handles federal and state taxes, integrates with your accounting and time-tracking software, stores your employees’ information securely, and even tracks employee hours, so you can determine if they are eligible for overtime pay.

This tool allows you to perform unlimited monthly pay run cycles, which makes it perfect for small businesses with multiple payroll schedules for different employees. The tool can accommodate daily, weekly, biweekly and semimonthly pay run cycles simultaneously.

Features

- Pay employees by direct deposit, debit card or check at no extra cost

- Withholds federal, state and local payroll taxes; pays taxes; and files Form 941 quarterly and Form 940 annually

- Allows employees to onboard themselves, sign HR paperwork and request PTO

- Can integrate payroll data with QuickBooks Online, QuickBooks Desktop, Xero, FreshBooks and other business services, such as time-tracking applications

Pros

- Unlimited monthly pay runs

- Free W-2 and 1099 processing

- Automated tax payments and filings

- No add-on fees

- One-month free trial available

- Employee self-service

Cons

- Sometimes considered a less intuitive platform

- No live customer support available on weekends

Pricing

OnPay’s pricing structure is simple. It only has one plan that covers all of its services, so there’s no need to worry about paying extra for features you might not need. The OnPay monthly base fee is $40 per month, plus $6 per employee per month.

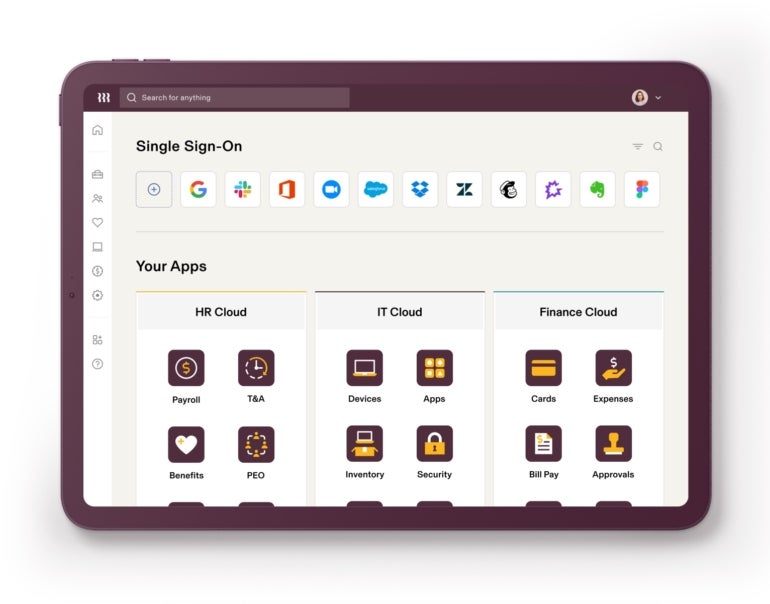

Rippling: Best for consolidating HR, IT and finance business functions

Rippling is a full-service employee management platform that streamlines the entire HR process. It lets you organize and manage employees, benefits, expenses, time off requests, devices and apps. The software also offers IT and security solutions such as app and identity management as well as device and inventory management to manage all business devices.

Rippling allows you to manage your global and local workforce from a unified system and includes rich reporting, customization tools and seamless integrations with cloud-based services. It delivers robust features for managing the business workforce across locations and functions. In addition, Rippling claims it takes approximately 90 seconds to onboard employees and contractors onto their platform.

Features

- Automates onboarding and offboarding process

- Enables small businesses to pay employees and contractors in their local currency

- Issues and manages corporate cards for employees

- Provides unified workforce directory, analytics and policies

- Supports professional employer organization (PEO) model

Pros

- Available in all 50 U.S. states and internationally

- Provides federal, state, local and international tax filings

- Benefits administration for dental, vision, medical and 401(k)

- Employee self-service features

Cons

- No free trial is available

- No standard subscription plan is available

- Steep learning curve for new users

Pricing

Rippling is a quote-based tool with no set subscription plans. Pricing starts at $8 per month per user.

Justworks: Best for professional employer organization model

Justworks is a PEO solution that helps small businesses manage their payroll, HR, benefits and compliance. Justworks allows you to schedule online payroll and automate direct deposits for full-time and part-time employees.

It also electronically files W-2s, 1099s and payroll taxes such as 940s and 941s. With the Justworks mobile app, it’s easy for employees to manage pay stubs, benefits and time off requests on the go. In addition, customers can reach support teams through multiple channels, including phone, SMS, email, chat or Slack.

Features

- Integrates with Xero and QuickBooks

- Provides compliance support for workers’ compensation, unemployment insurance filings and ACA Filings (1094-C and 1095-C)

- Automated direct deposit

Pros

- IRS-certified PEO (CPEO) and ESAC accredited

- Efficient customer support teams

- Appealing user interface

- 24/7 customer support from experts at Justworks

- Support for weekly and biweekly pay frequencies

Cons

- Direct deposit may take two to four days to drop

- Can get pricey for extremely small teams

Pricing

Justworks has two plans:

- Basic: $59 per employee per month for a team of fewer than 49 employees. $49 for your 50th employee and beyond

- Plus: $99 per employee per month. $89 for your 50th employee and beyond

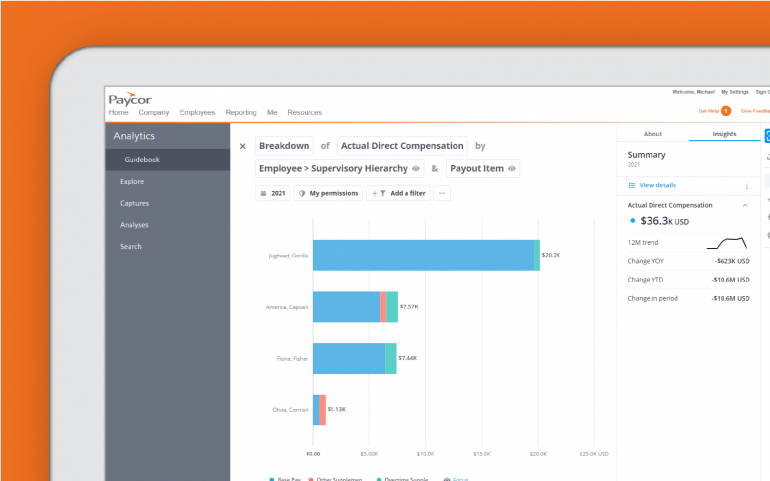

Paycor: Best for reporting and analytics

Paycor is a full-service human capital management solution that includes payroll and HR features. Founded in 1990, Paycor provides cloud-based, customizable HR solutions to thousands of clients throughout the United States.

With features like electronic onboarding and an employee self-service portal, this software has all you need to manage your employees’ compensation, benefits, performance reviews, training plans and payroll tax filing requirements.

Paycor serves businesses in various industries, including healthcare, manufacturing, restaurants, professional services and nonprofit organizations. The platform offers advanced analytics that gives managers insight into their workforce, allowing them to make better hiring, retention and promotion decisions.

Features

- Analytics and reporting

- Employee performance management

- Payroll and tax services like federal and state tax filing, direct deposit, check stuffing, auto-run payroll, and new hire filing

- Library of standard reports, a custom report writer and scheduled reports

- Paycor analytics features for benchmarking, diversity and inclusion metrics, prebuilt dashboards, and compensation insights

Pros

- A+ rating from BBB

- Feature-rich tool

- Offers advanced analytics and customizable reporting tools

- Waived setup fees on all plans

- Employee self-service

Cons

- On the pricier end of payroll solutions for small businesses

- Employee self-service portal could be improved

Pricing

Paycor provides four primary pricing plans for small businesses, based on the features you need and the number of employees you have:

- Basic: Begins at $99 per month, plus $5 per employee per month

- Essential: $149 per month, plus $7 per employee per month

- Core: $199 per month, plus $7 per employee per month.

- Complete: $199 per month, plus $12 per employee per month.

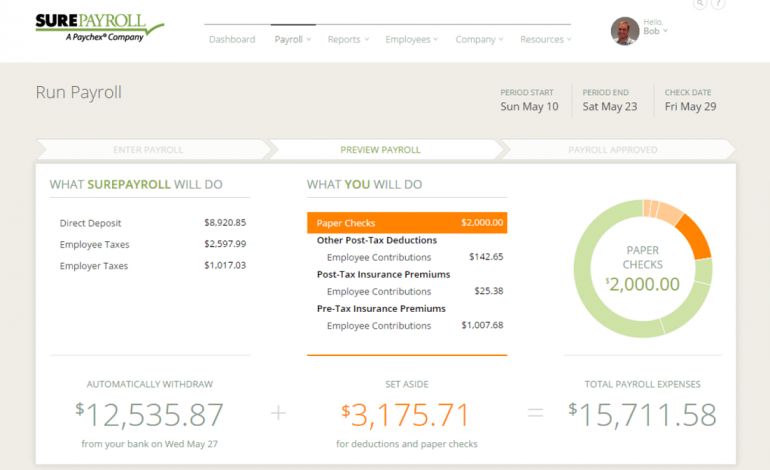

SurePayroll: Best for DIY and affordability

Backed by an industry-leading payroll service provider — Paychex — SurePayroll is one of the best payroll platforms for small businesses. With SurePayroll, you will have the essential features to manage your company’s paychecks for full-time, part-time, salaried, hourly and/or contracted employees. The tool also offers support for paying federal and state payroll taxes on time.

This solution integrates with other accounting software, including Intuit QuickBooks, Xero and Less Accounting. It also allows you to perform unlimited payroll runs at no extra cost. Business owners looking to save money on payroll processing can use the self-service option, which will enable you to pay employees with unlimited payroll runs and e-file taxes yourself.

Features

- FSA and HSA fund management

- Offers direct deposit and online pay stubs

- Tax calculation and filing

Pros

- A+ from BBB

- Affordable

- Easy to use

- Payroll can be processed on the mobile app

Cons

- Charges fees for integrations

- Limited HR capabilities

Pricing

SurePayroll offers affordable pricing plans to users. Currently, plan prices can be discovered by quote.

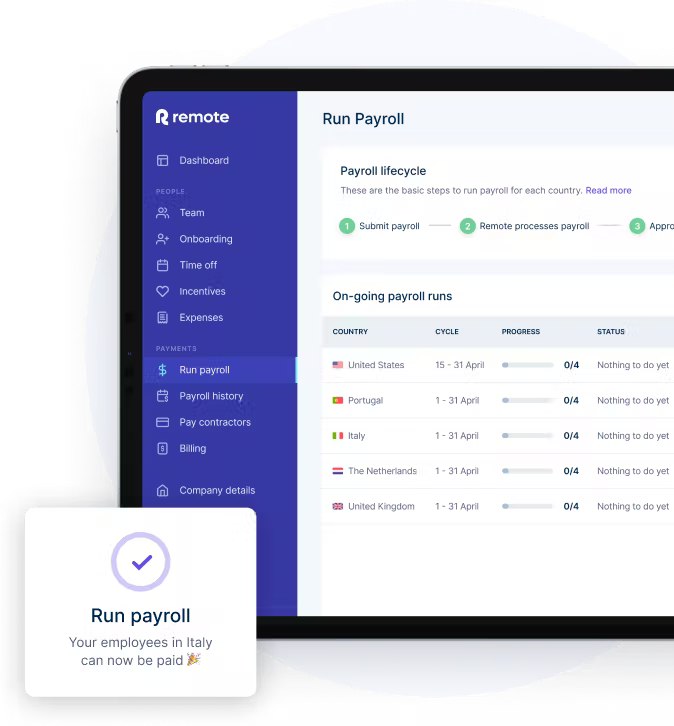

Remote: Best for distributed teams

Remote is a global payroll solution for distributed teams. They offer country-specific benefits packages, multi-currency support, and compliant data and reporting solutions to help you keep your business on track and on the right side of tax law, regardless of employee locale.

Remote also provides HR capabilities that allow small businesses to hire international employees or contractors without worrying about handling taxes and payrolls. With over 150 countries serviced, it’s a flexible way to manage payroll.

Features

- Automatically generates 1099s for U.S. contractors

- Offers intellectual property and invention rights protection

- Supports third-party software integration

Pros

- Compliance with local laws

- Easily onboard international employees

- Offers contractors-only plan option

Cons

- Customer support via email only

- Lack of 24/7 support

Pricing

Pricing for Remote varies depending on how many users you have and what services you need. Remote offers two primary pricing editions:

- Employer of Record: $699 per employee per month paid monthly or $599 per employee per month paid annually

- Contractor Management: $29 per contractor per month

Pricing information for the Global Payroll and Remote Enterprise plans is available upon request.

What is payroll software?

Payroll software is a type of accounting software that can be incredibly advantageous to small business operations, as these solutions automate and streamline many payroll-related tasks. These tasks include calculating wages and deductions, preparing paychecks, and sending them to employees electronically.

Key features for payroll software solutions

Comprehensive HR features and integrations

Payroll software is often offered as part of a larger human resources management system suite. For many small businesses, this is crucial to a more seamless workflow and improved IT tool sprawl.

SEE: Oracle vs. Workday: A comparison of HR software (TechRepublic)

Consider investing in an HRMS that offers payroll functionality alongside applicant tracking, compensation management, time and attendance, talent management, performance management, and/or benefits administration. You should also consider payroll software that integrates with other software that is crucial to your business operations, such as accounting software.

User-friendly dashboards

The interface of your payroll software should be straightforward, allowing users to make changes intuitively and see what needs attention quickly. It’s essential that the design is intuitive, so users will feel comfortable navigating through it on their own.

Income tax forms

Payroll software must be compliant with all applicable income tax laws, ensuring the company avoids penalties or fines for noncompliance. Income tax forms help with this kind of compliance while also making it easier to export data directly into an online e-file application, thus saving time and reducing human error.

Self-service capabilities

Many businesses give employees access to their accounts and permissions for data they can edit themselves, such as time off requests. Some even offer web portals for customer self-service. This means that clients who have purchased products from these companies can log in and check the status of their orders without having to call customer service.

Import/export capabilities

Good payroll software has plenty of import and export features. The ability to import third-party pay information such as bonuses, pensions or commissions is a highly sought-after payroll software functionality. Having the option to generate W-2s and store them electronically is another top import and export capability that significantly reduces processing times.

Compliance support

Regardless of your business, staying compliant with government and industry regulations is crucial. Employers must ensure that whatever payroll solution they select satisfies any requirements specific to their industry. The best payroll software offers features for employment eligibility verification and other fraud-prevention measures.

Value-added services

Many smaller companies rely on outside partners for benefits management or HR services. When choosing a payroll solution, businesses in this position should make sure the software provider they choose integrates seamlessly with outside vendors to reduce redundancies and simplify the benefits administration process.

Support for time card management and other processes for hourly workers

If you hire and manage hourly employees, you’ll likely require a payroll solution that imports your employees’ hours in real time. This is especially true for companies that run their payroll biweekly, semimonthly or monthly.

Customizability

Organizations may require different features and functions depending on their size, geographic location or number of employees. Being able to customize your payroll solution is essential to meeting niche compliance and operational needs.

Support for payroll tax requirements

You must understand how payroll taxes are handled for your location, so you can choose the best system for your situation. If you are located in a state that requires quarterly reports, it would be best to choose a payroll solution that accommodates this requirement. Other taxes to consider are unemployment insurance, Social Security and Medicare. Be sure to talk with your accountant about the best ways to handle these taxes and how they apply to your company’s location.

Benefits of working with payroll software

Working with payroll software is a great way to make sure your employees are paid accurately, on time and without hassle. Payroll software also eliminates the need for you to worry about federal and state regulations related to payroll and ensures all appropriate tax withholdings are accounted for in your employee’s paycheck.

SEE: Top data governance tools (TechRepublic)

Payroll software also allows you to keep track of working hours, calculate overtime wages, set up new hires and termination letters, pay taxes out at regular intervals or add individualized pay rates per position as needed, and calculate holiday payouts or accruals.

Employees can track their information, input information for vacations and other time off, and see what deductions will be taken from their paychecks for things like health insurance premiums and 401(k) contributions. With the right payroll software in place, your HR and finance teams will have automated support for the payroll process and your employees will have quick and simplified access to their earnings.

How do I choose the best payroll software for my small business?

The best payroll software for you depends on your business needs. The right choice can make managing your staff easier, reduce tax liability and help you stay in compliance with IRS regulations.

When shopping for the best payroll software for your small business, start by deciding which features are most important for your business needs. Take into account how much time and money you want to invest upfront, what you will need the system to do and how many employees you have on your team.

One thing to keep in mind is that payroll software might not be a one-time purchase. Make sure you budget for upgrades and add-ons over the course of your contract term, so you only end up paying what was expected.

After you’ve determined what functions and features you need, make a list of all of these vital payroll features, and rank them in order of importance. Use this list when interviewing and researching potential providers to determine which product is right for you and which payroll software vendors offer the best value-adds.

Read next: The best applicant tracking systems (TechRepublic)