For several years, banks have been facing disruption from fintech. Through embedded services, fintech companies have given customers the opportunity to bypass banks.

For banks, addressing the disruption means embracing the same principles fintech organisations are and redoubling a focus on real-time interactions and a deep customer experience. Addressing this challenge has been a principal goal of Thailand’s SCB, particularly in the wake of the challenges that arose at the start of the COVID-19 pandemic.

The need to digitise in an era of high disruption

SCB is the second-largest commercial bank in Thailand, but was facing some significant challenges due to lockdowns and lower mobility of people throughout the beginning of the pandemic. The bank was forced to close many of its branch offices, and the number of loans it issued declined rapidly. At the same time, updates in the regulatory environment meant that it needed to meet new requirements for more inclusive loan financing.

The bank found the answer to these challenges in digitisation. SCB decided to pivot and build a new digital finance ecosystem. Within that, it would develop food and drink, healthcare, and other critical services. Most critically, the new system would have a real-time, excellent user experience and would instantly modernise the way it interacted with its customers.

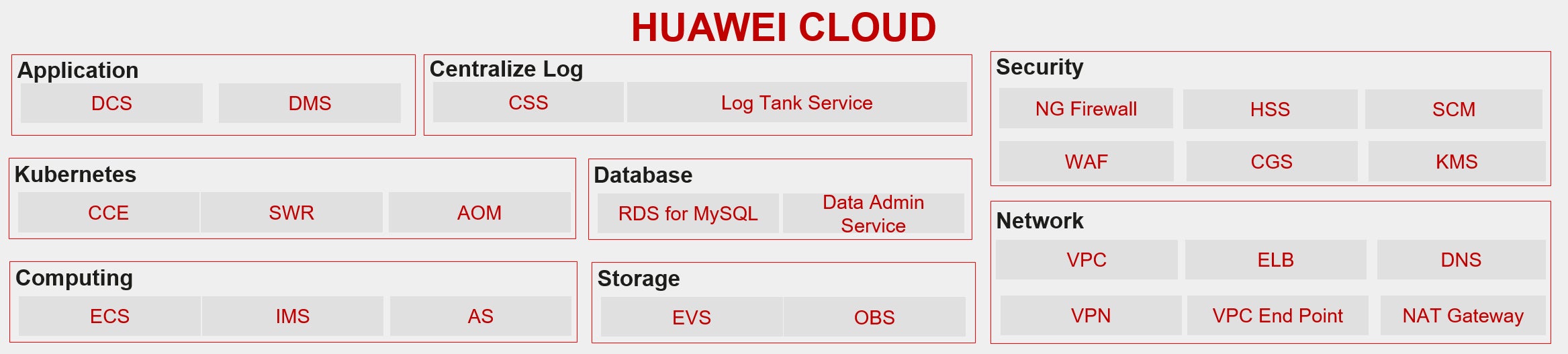

To achieve this, SCB turned to fintech specialist IT services firm, Sunline, to develop a digital loan application that would be deployed to the Huawei DBank cloud. This was part of the broader relationship that Huawei and the bank had formed. As SCBX CEO, Arthid Nanthawithaya, said when the bank signed a MOU with Huawei last year: “Cloud and digitization are the general trends in the development of financial technology companies. Huawei Cloud is the world’s leading cloud vendor. The cooperation with Huawei in cloud strategy will accelerate SCBX’s cloud transformation and business strategy development. Our collaboration is to drive thought leadership and excellence in cloud, making SCBX a cloud-first company.”

Meeting an ambitious goal

SCB’s project goal is to reach 200 million digital users by 2026. To achieve this, it needed the digital loan application system to excel in three areas.

- SCB needed the system to be quick and the user experience to be excellent. This is both in terms of the latency within the app, which Huawei delivered with a response latency of 0.1s, and the length of time taken to approve loans — a reduction from weeks to, in most cases, under five minutes.

- The system needed to be scalable to meet SCB’s rapid growth goal. To this end, the Huawei solution allows the bank to optimise costs by scaling resources dynamically as traffic fluctuates in real time.

- The solution needed to be secure. Banks are always expected to meet the most stringent of security and regulatory requirements, and innovation can’t come at the expense of the utmost focus on this. Huawei Cloud was selected because it provides various security services and permissions management methods that build a set of landing zones that meet government PDPA requirements and BOT regulations.

The results were immediately impressive. SCB rolled out its services three months ahead of schedule.

Banks need to find new ways to compete

While COVID-19 accelerated the disruption that banks like SCB have faced, the trends were in place long before the pandemic. The biggest challenge these banks face is the younger generations. Millennials and Gen Z are the future demographics banks need to appeal to. These generations have been raised on digital technologies and have come to expect the immediacy they provide.

What’s more, they have an increasing appetite for consuming financial services, albeit not through traditional means. Across South-East Asia the percentage of the unbanked remains incredibly high, even as financial participation increases and, in many cases, bypasses the banking system entirely.

“[Banks are] under threat from fintechs and big techs, which are (predictably) targeting banking’s rich seams of profit,” one recent McKinsey report notes. “More than 80% of fintech activities, for example, are concentrated in payments, consumer lending, and wealth management. The result is a steady disaggregation of these profit centres from the banking value chain.”

This is particularly true in South-East Asia, where some 70% of the population are unbanked or underbanked. As a Macquarie Group article notes, nations like Indonesia, Thailand, Vietnam, and Malaysia have populations with high levels of digital literacy and mobile internet access, but a high percentage of them don’t interact with banks.

“The inaccessibility of the established banking system for many has provided the ideal backdrop for providers of digital financial services to step in and supplement its services,” the report notes.

From disruption to competitive advantage

There’s no reason that banks across South-East Asia should be unable to manage these disruptive market forces.

It starts by bringing banking services to consumers through their preferred medium. As the World Economic Forum notes, in addition to the unbanked, credit card ownership across South-East Asia is incredibly low; however, the vast majority of people have mobile phones capable of processing payment information.

Furthermore, after successfully understanding digital transformation and moving to such platforms, banks can broaden their potential customer base by assessing loan applications in less traditional ways.

“Digital finance services providers are using big data like online purchase histories and informal worker earnings to develop customer risk profiles for people who lack credit scores,” the WEF notes. “For example, in Indonesia, Grab has collaborated with JULO, a digital credit provider, to provide same-day micro loans to drivers and delivery partners.”

Financial services organisations can also use the agile and real-time capabilities of their transformed environments to provide greater flexibility with payments based on use. Banks can break payments up into smaller, bite-sized payments that are spread over time, for example, and by doing so, they can significantly increase engagement through the affordability of their services.

SCB is a pathway to follow

The SCB story is a model and pathway for other banks across South-East Asia, and other underbanked regions in the world, such as Latin America and Africa. By moving quickly to a secure cloud platform and focusing on a real-time user experience, banks can start building innovative services immediately, engage with communities that never previously held bank accounts, and adopt a flexible approach to innovation going forward.

The secret is to find the right partners that can deliver this while remaining compliant with the strict regulatory environment that banks need to manage. Huawei Cloud has launched 78 availability zones (AZs) in 29 Regions and serves customers in more than 170 countries and regions.

Huawei Cloud’s ability to grow to this extent highlights its ability to contribute meaningful value across a wide cross-section of industries, including financial services, through its vision for ubiquitous cloud and pervasive intelligence.

For more information on Huawei Cloud solutions for financial services, click here.