-

ADP TotalSource: Best overall PEO

-

Rippling PEO: Best for technology management

-

Paychex: Best for midsize businesses

-

Justworks: Best for small businesses

-

Papaya Global: Best for international companies

-

TriNet: Best for specific industries

Professional employer organizations, or PEOs, are HR companies that handle other business’s complex HR needs. If your business partners with a PEO company, the PEO will take everything employee-related off your hands, from hiring and onboarding to payroll, benefits and taxes.

PEOs are more expensive than in-house HR and payroll software solutions. Additionally, PEOs must become legal co-employers with your business so they can file payroll taxes on your behalf. As long as you have the budget for it and are fine sharing ownership of your company with a third party, working with a PEO can give you time to focus on running your business instead of dealing with HR.

Jump to:

- Top PEO companies: Feature comparison table

- Top PEO companies of 2023

- ADP TotalSource

- Rippling

- Paychex

- Justworks

- Papaya Global

- TriNet

- How to choose the right PEO company

Top PEO companies: Feature comparison table

| Full-service payroll | Benefit administration | Hiring and onboarding tools | Global payroll and benefits | Starting monthly price | |

|---|---|---|---|---|---|

| ADP TotalSource | Yes | Yes | Yes | Yes (140+ countries) | Unlisted online |

| Rippling PEO | Yes | Yes | Yes | Yes | $35 + $8/employee |

| Paychex PEO | Yes | Yes | Yes | Yes (through third-party integration) | Unlisted online |

| Justworks | Yes | Yes | Yes | No | $59/employee |

| Papaya Global | Yes | Yes | Yes | Yes (160+ countries) | Unlisted online |

| TriNet | Yes | Yes | No | No | Unlisted online |

Top PEO companies of 2023

Competing PEO companies offer outsourced HR solutions that include rapid onboarding, automated tax and payroll, and remote equipment management. Each PEO solution reviewed below aims to be a one-stop shop for the entire employee lifecycle, but each competitor offers different human resource services at different price points.

These are the top PEO companies for 2023.

ADP TotalSource: Best overall PEO

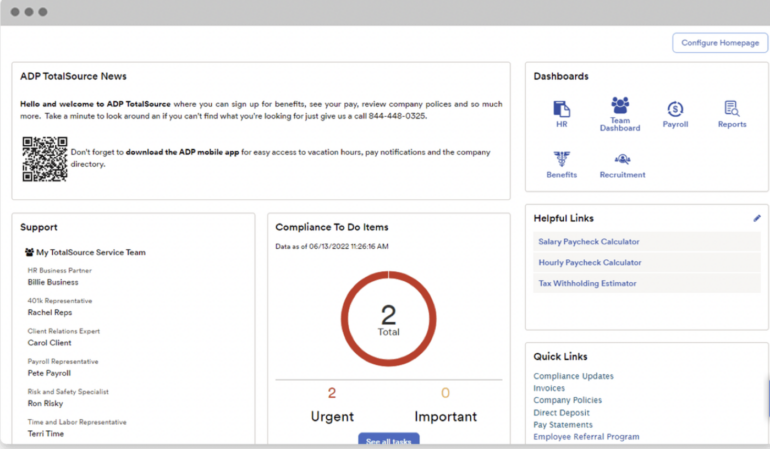

ADP is a payroll and HR company that offers multiple employee management solutions for all types and sizes of businesses. While ADP offers well-reviewed payroll software scalable for small, midsize and large businesses, the company is probably best known for its PEO service, ADP TotalSource.

ADP TotalSource focuses on small and midsize businesses with between five and 250 employees. Once you choose ADP as your co-employer, the company will manage your workers’ compensation payments, payroll processing, payroll tax filing and employee benefits. While ADP doesn’t perform every single HR task, it does provide thorough HR support as an HRBP, or HR business partner.

Features

- Payroll: Full-service payroll administration, including automatic unlimited payroll runs and full-service payroll tax withholding and remittance. ADP collaborates with globalization partners to process global payroll in 140+ countries.

- Employee benefits: Health insurance plans available in all 50 U.S. states. Group health insurance for up to 150 employees available through ADP’s brokerage, which syncs with payroll for easy insurance premium deductions. Retirement plans, including 401(k)s and SIMPLE IRAs.

- Time and attendance: Digital time clock via ADP’s app. Automatic manager alerts and approval settings for time-off and scheduling requests. Easy access to ADP’s compliance experts for legal guidance on wage and hourly employment laws.

- Hiring and onboarding: Pre-employment screenings conducted by ADP, including background checks and credential verification. Customizable online onboarding courses get new employees up to speed quickly.

- Skill and resources: Incredibly comprehensive resource libraries and dedicated teams of experts to help with everything from HR compliance to best practices to minimize employee turnover.

Pros

- Decades of experience as an IRS-certified PEO.

- More thorough PEO services than almost every competitor.

- Expansive resource library and expert insights into compliance, employee retention and key business metrics.

- Highly rated apps for employers and employees.

Cons

- Too expensive for some members of ADP’s target audience (small businesses).

- Limited plan customization.

- No clear pricing on ADP’s website.

Pricing

Like most PEOs, ADP requires you to call its sales team directly to get a quote.

Rippling PEO: Best for technology management

Rippling PEO differentiates itself from the market by offering a combination of HR, IT and finance solutions in one dashboard. The cloud-based solution also leverages automation in most of its processes.

Rippling’s PEO solution guides users through complex tax, onboarding and payroll executions with guided step-by-step instructions, providing high levels of accessibility to teams. It also offers reports, training and skilling, competitive pricing and global payroll capacities.

Features

- Payroll: Highly automated global payroll management can manage thousands of remote workers, regardless of location and provide coverage in all 50 U.S. states.

- Employee benefits: Fully automated benefits, health insurance, 401k, commuter and more, all in one system. Enrollment of new hires, deductions and COBRA administrations. Allows companies to compare and enroll in more than 4,000 plans from the nation’s leading carriers, including Aetna, Humana and Blue Cross Blue Shield.

- Time and attendance: Automatically track employees’ hours from clock-in to paycheck. Avoids manual data entry, syncing issues or late approvals from supervisors.

- Hiring and onboarding: Includes automated data employee lifecycle features in its HR core.

- Skill and resources: Provides extensive support for HR, IT and finance teams as well as courses for employees, tools to develop work culture, work policies, growth opportunities, integrations and more.

- IT and Finance: Unlike other PEO solutions, Rippling offers finance and IT teams tools to manage employees’ technology, computers, equipment and financials.

Pros

- Highly automated.

- Combines HR, IT and Finance unlike no other PEO.

- Cost efficient and scalable.

Cons

- May be complex to manage for beginners.

- Initial setups can be time-consuming.

Pricing

Rippling PEO’s base price isn’t listed online. However, the starting price for its standalone payroll solution is $8 per month for every user. Additionally, every customer can add HR and IT components like Payroll, Benefits, Device Management and others. These can be purchased separately. Whether you choose Rippling PEO or one of its standalone HR, tech or payroll modules, you must purchase the core Rippling Unity Platform as well, which costs an unlisted monthly base fee.

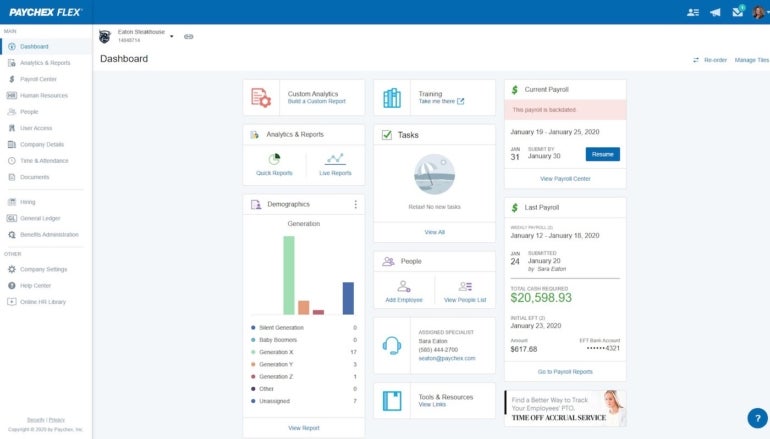

Paychex: Best for midsize businesses

Paychex PEO is a solid PEO solution that helps companies of any size, from small businesses to midsized or enterprise level. However, its level of customer support and thorough features make it a particularly good fit for growing and midsize businesses. The company also offers a product called Paychex Flex, a cloud-based payroll software tool that helps companies hire, pay, manage and retain employees. Paychex is one of ADP’s biggest competitors in both the payroll software and PEO spheres, and the two companies share many of the same features, pros and cons.

Features

- Payroll: Features employee retention tax credit for savings opportunities. Multiple payment options for payroll processing, pay-on-demand (prior to payroll date) and 24/7 real-time payments. It has built-in safeguards and compliance support to meet tax laws and regulations.

- Employee benefits: Offers a comprehensive employee benefits package, including 401(k) plans, HSAs and the financial wellness tool, FinFit for a financial wellness program.

- Time and attendance: Its cloud-based time and attendance solution supports businesses of all sizes and many working environments.

- Hiring and onboarding: Provides HR professional guidance from experts and HR solutions to attract and retain talent, streamline onboarding and ensure worker safety. It also supports live workers´ communication channels.

- Skill and resources: It provides employees the opportunity to develop and grow in their careers with courses they can access online.

- Customer support: All plans include 24/7 multichannel support. Employees can reach out to Paychex directly with any questions about either the software itself or their benefits and pay.

Pros

- Good for any sized company and those looking to scale.

- Excellent customer support.

- Comprehensive HR and payroll technologies.

Cons

- No online pricing disclosure for most Paychex components or plans.

- Might be too comprehensive and expensive for small businesses.

Pricing

Paychex doesn’t list the pricing for its PEO service online. Instead, potential customers must directly request a free customized quote. Paychex Flex starts at $39 a month plus $5 per employee paid per month, which is an industry standard price for payroll software.

Justworks: Best for small businesses

Operating since 2012, Justworks is a simple PEO solution for managing payroll, employee benefits, HR and compliance. Its robust cloud-based system with healthy scores across various review sites.

While the platform is excellent for small and medium businesses for organization-wide payroll, medical, dental, vision, 401(k), life insurance, AD&D and more, it can be costly. The company does offer 24/7 support, but some features are not available in the Basic plan.

Features

- Payroll: The platform offers automated deposits, one-off payments, payroll tax filings, auto notifications, synced time and attendance, and compliance, including filing W-2s, 1099s and 940/941s.

- Employee benefits: The platform works directly with health insurance carriers to provide employee benefits plans that are typically only available in the large group market. These include health insurance benefits, wellness services, deductible HSA, on-demand primary care services, life insurance, 401(K), HSAs, commuter benefits and more.

- Time and attendance: Available and synced to payroll. Advanced time tracking features are not available for the Basic plan.

- Hiring and onboarding: Provides basic hiring and onboarding features for hiring remote, national, or international teams and contractors.

- Skill and resources: The resource center is mostly oriented to better managing the PEO solution.

- Customer support: 24/7 support.

Pros

- Automatic tax filing, comprehensive payroll and HR system.

- 24/7 support.

- Transparent online pricing.

Cons

- Expensive.

- Basic plan is limited and advanced features may require additional payment.

- No global payroll.

Pricing

Justworks price for the Basic plan is $59 per month per employee for the first 49 employees and then $49 per month per employee. The Plus plan, which includes everything the basic plan provides plus access to medical, dental and vision, is $99 per month per employee with a discount set at $89 per month for the 50th employee onwards.

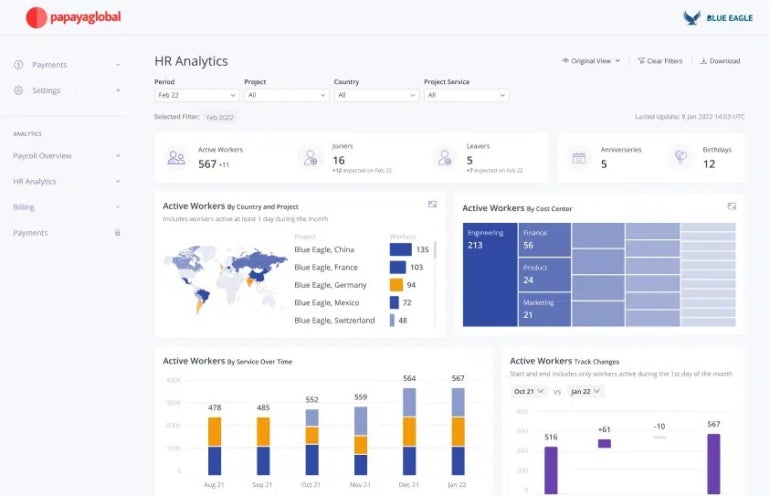

Papaya Global: Best for international companies

Papaya Global is the PEO for companies with international workforces. While Papaya offers all the payroll, HR and hiring and onboarding features that most platforms provide, it sets itself apart with a strong focus on managing global talents.

Papaya adapts to the age of hybrid work, where talent can come from anywhere. It operates in over 160 countries with all types of employment. The user-friendly platform comes in an all-in-one system with great data visibility, automation tools and reporting. Its customer support, however, is not 24/7, and it can be expensive for small companies.

Features

- Payroll: Global automated payroll management. Support all worker types. Provides a compliance engine, checks data accuracy and can run audits and reports over multiple countries. Offers over 60 currencies and payments delivered within 72 hours.

- Employee benefits: Provides an international health plan to cover employees in more than 160 countries. For the U.S., Papaya Global complies with U.S. requirements.

- Hiring and onboarding: Consolidate all hiring and onboarding of all workers (payroll, EOR, contractors) into one streamlined platform that meets each country’s compliance.

- Skill and resources: Its resource center mostly focuses on payroll, HR and payment information for global and international operations.

- Customer support: Monday through Friday, 9 am to 5 pm ET.

Pros

- User-friendly, highly automated and data-driven dashboards and visualizations.

- Complies with international payrolls and standards.

- Provides comprehensive payroll and HR global platforms.

- Transparent online pricing.

Cons

- Its focus is on global workforces. U.S. companies may not require most features.

- Can be expensive for small companies.

- Lacks 24/7 support.

Pricing

Papaya Global offers different plans and customers can customize their own online. If you want to integrate your current payroll software with Papaya’s PEO platform, the starting price is just $3 per employee per month (on top of whatever you pay your payroll provider). Full-Service Payroll, which includes global payroll, costs $12 per employee per month.

Papaya Global’s more comprehensive services cost quite a bit more than its payroll-only solution. Its Employer of Record service starts at $770 per month per employee, while the Contractor Management costs $25 per month per contractor. Finally, the Global Expertise Services plan, which includes international healthcare and employee benefits administration, starts at $250 per month.

TriNet: Best for specific industries

Unlike the other best PEO companies on our list, TriNet’s PEO solutions are industry specific. While all of its PEO plans include standard PEO features, like automated payroll and comprehensive employee benefits, each individual plan is specifically tailored to your industry’s needs — especially your industry’s specific labor compliance regulations.

If TriNet is too expensive or too comprehensive for your business, TriNet-owned Zenefits could be a good alternative. It offers more generic features at a lower starting price.

Features

- Payroll: Full-service payroll, including automatic tax withholding and direct deposit in all 50 U.S. states. Easily integrates with popular accounting solutions like QuickBooks Online and Xero. Payroll invoice estimates to help you budget for your next payroll run.

- Employee benefits: Full medical, vision and dental insurance coverage from top providers like Aetna and Blue Cross Blue Shield. Unique employee benefit options like commuter benefits, brand-specific discounts (including AT&T, Verizon and Hyatt) and 401(k)s.

- Time and attendance: Managers can create daily, weekly and monthly schedules and schedule breaks. Comprehensive reports and easy-to-read data graphics.

- Hiring and onboarding: Useful talent retention and off-boarding tools, but extremely limited hiring and onboarding features or support.

- Skill and resources: Cloud-based learning management suite with over 500 courses, including courses that count toward role- and industry-specific certification. Leadership-training workshops with an emphasis on HR.

- Customer support: 24/7 support available year-round except on certain U.S. holidays.

Pros

- Industry-specific HR specialists help unique businesses stay compliant.

- Expansive traditional and non-traditional benefit options.

- Plans broken down by industry type and company size, starting at companies with five to 19 employees.

- Dedicated “relationship manager” serves as a single point of contact for customer support.

Cons

- Few hiring, talent acquisition or onboarding tools.

- Limited report customizability.

- Limited assistance with multi-state payroll.

Pricing

TriNet doesn’t transparently list its prices online. However, when you request a quote, you’ll get a customized line-item list that clearly explains exactly which features you’ll be charged for and exactly how much each costs.

How to choose the right PEO company

There is no one-size fits all solution when choosing a PEO company. While some PEO technology may sound attractive for small companies, big enterprises with large workforces may require other features.

Several factors need to be considered before purchasing a PEO: Before contracting with a PEO company, consider factors like budget, number of employees, benefits that your organization offers, where you operate, what type of automation you require, what work culture you are building and how complex your compliance situation is. It’s also important to discuss HR, IT, payroll, accounting and finance tools with your respective teams to know which platform they are more comfortable with and gain better insight into what your talent needs.