-

ADP: Best for PEO services

-

Gusto: Best overall

-

Intuit QuickBooks OnlinePayroll: Best for fast direct deposits

-

OnPay: Best for very small businesses

-

Patriot Software: Best for simplicity

-

Paychex: Best for growing businesses

-

Sage HRMS Payroll: Best for HR services

-

Square Payroll: Best for retailers and contractor-only businesses

For many small businesses, processing employee payroll week after week, month after month and year after year can be a tedious, time-consuming and relentless endeavor. Writing paychecks and filing payroll tax returns takes you away from what you really want to do — serve your customers and sell your products.

SEE: Payroll processing checklist (TechRepublic Premium)

The time-consuming nature of payroll processing is why many small businesses contract with third-party payroll companies. Continue reading to learn more about the top payroll processing services for small businesses like yours.

Jump to:

- Top payroll processing services for small businesses

- What features should you look for in payroll services?How do payroll services work?

- How do I choose the best payroll processing service for my business?What features to look for in payroll services?

- Methodology

Top payroll processing services for small businesses

Payroll services are invaluable for small businesses that need help managing their payroll and associated compliance requirements. One of the payroll companies below could meet your business’s payroll needs, but if you don’t find a perfect match here, we review several other payroll companies on our list of the year’s best payroll software for businesses.

| Automated processing | Advanced reporting | Mobile payroll app available | Free trial available | |

|---|---|---|---|---|

| Yes | Yes | Yes | Yes |

| Yes | Yes | Yes | No |

| Yes | Yes | No | Yes |

| Yes | Yes | No | Yes |

| Yes | No | Yes | Yes |

| Yes | Yes | Yes | No |

| No | Yes | No | Yes |

| Yes | No | Yes | No |

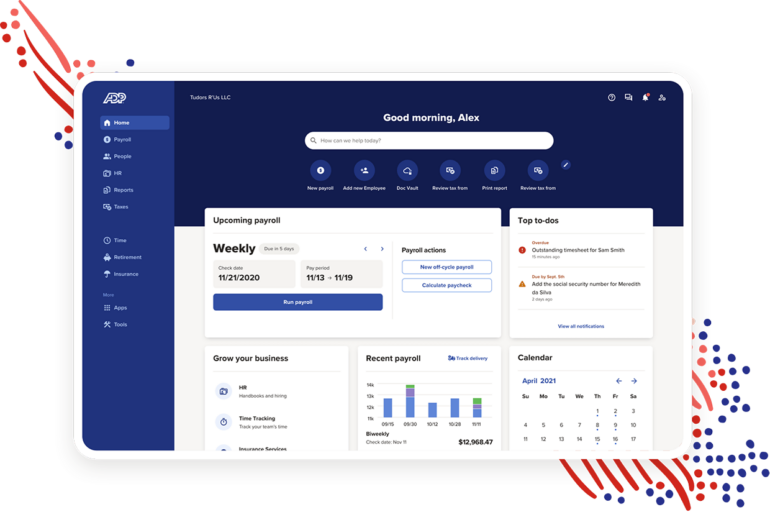

ADP: Best for PEO services

ADP offers a full array of payroll processing services, employee benefits management, insurance services and human resource tools. ADP’s payroll solution is designed to accommodate businesses ranging from single employees to thousands of employees, ensuring they get paid correctly and in a timely fashion.

Along with its payroll software solution, ADP also offers a professional employer organization service. As a PEO, ADP partners with small and midsize businesses to become a co-employer and take over the most essential human resources tasks. You and your employees will use ADP’s software and apps, but ADP will manage most of HR on your behalf. ADP’s payroll software is a more affordable alternative for small businesses that don’t mind handling their own payroll processing in house.

Key features

- All-in-one payroll, time tracking and benefits management software

- Automated deduction calculations for tax and retirement contributions

- Comprehensive reporting for employee pay, hours worked and taxes withheld

- Employee benefits included

- Automatic filing for all payroll taxes

- Three-month trial period

- Time tracking included

- Unlimited processing

- Web/mobile interface

Pros

- Comprehensive HR features

- A+ rating from BBB

- Mobile app

- Federal, state and local compliance support

Cons

- Lack of transparent pricing

- Setup and usage complexities for newer users

Pricing

The more services your business uses, the more costs it will incur. If you decide to use ADP’s payroll software only, ADP offers four pricing plans: Essential Payroll, Enhanced Payroll, Complete Payroll & HR Plus, and HR Pro Payroll & HR. The Essential Payroll package is the best fit for most small businesses. ADP does not advertise its prices, so you’ll need to contact the company directly for a quote.

If you use ADP’s PEO services, the cost of payroll software will be included in your (much higher) PEO cost.

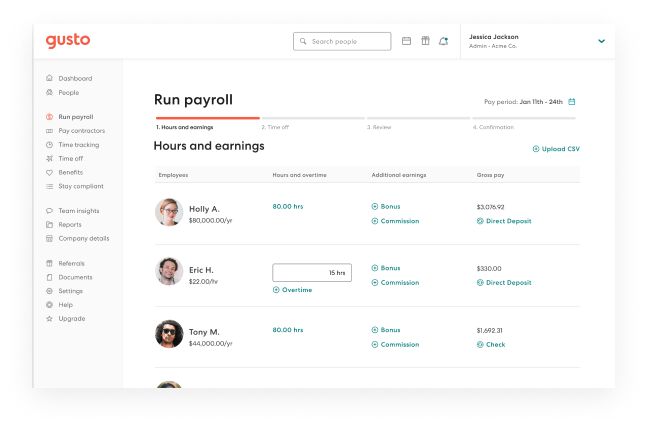

Gusto: Best overall

Gusto is a full-service payroll processing service for small businesses. It offers automatic payroll calculations, tax filing, direct deposit and time tracking. Additionally, Gusto has employee benefits such as health insurance, retirement plans and workers’ compensation.

Gusto’s payroll service has been designed from the ground up to be a cloud-based service. The company offers a complete array of payroll processing services and additional services like HR management, employee benefits, hiring and onboarding, and employee finance tools.

Key features

- A variety of employee benefits management options

- Employee self-service for accessing pay stubs, enrolling in benefits and making PTO requests

- Bookkeeping integration included

- Automatic filing for all payroll taxes

- Time tracking included

- Direct deposit

- Unlimited payroll runs

- Web/mobile interface

Pros

- Contractor-only version available

- Good user experience

- Affordable pricing

- Automatically files and pays state and federal unemployment insurance taxes

Cons

- Priority and full support are only offered in higher tiers

- Performance reviews are only available with the premium package

- HR compliance alerts are only available with the premium package

- No mobile payroll app

Pricing

Gusto offers three pricing plans with varying features. They include:

- Simple plan: Starts at $40 per month, plus $6 per month per employee.

- Plus plan: Starts at $60 per month, plus $9 per month per employee.

- Premium plan: Pricing for this plan is available upon request.

- Contractor: The base price is $35 plus $6 per month for each contractor. The base rate, however, is currently discounted; for the first six months, the customer will pay a flat rate of $0 and only $6 per month per contractor.

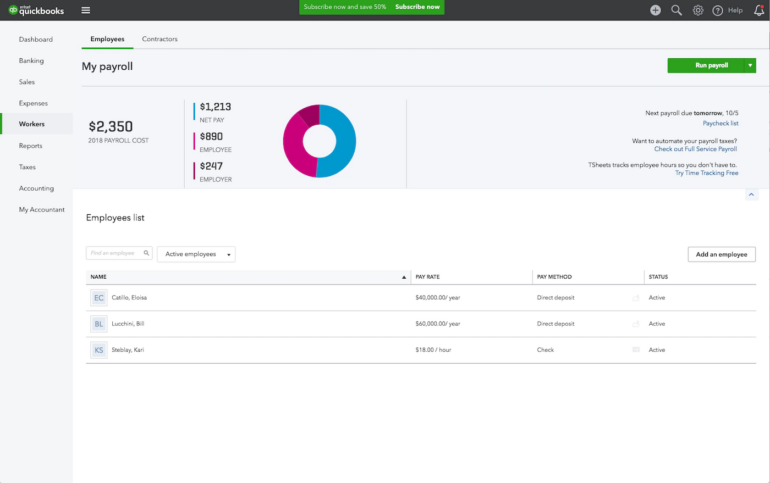

Intuit QuickBooks OnlinePayroll: Best for fast direct deposits

The Intuit QuickBooks payroll processing service is an online payroll service that integrates with QuickBooks accounting software. It helps small businesses manage their payroll and tax-related tasks quickly and easily — especially with automation for payroll processing, tax filing and direct deposit — allowing employers to comply with federal and state regulations. QuickBooks Online Payroll also helps employers track employee time and manage employee benefits.

Small businesses and owners adopting the QuickBooks accounting software often adopt the Intuit QuickBooks Payroll software system too.

While this payroll service includes full payroll processing services, it has a few more limitations when it comes to HR services. Integration with QuickBooks, however, is seamless.

Key features

- Same-day direct deposit (unavailable with cheapest plan)

- Automated taxes and forms

- Tax penalty protection for up to $25,000 (available with most expensive plan only)

- Bookkeeping integration included

- Employee benefits included

- Automatic filing for all payroll taxes

- 30-day trial period

- Unlimited processing

- Web interface

Pros

- QuickBooks Online integration

- Fast direct deposits

- User-friendly

Cons

- Basic HR features

- Customer support could be improved

Pricing

Intuit QuickBooks Online Payroll provides a 30-day free trial and a 50% discount on the purchase price for the first three months following purchase. They have three pricing options:

- Core: $22.50 per month, plus $4 per employee per month.

- Premium: $37.50 per month, plus $8 per employee per month.

- Elite: $62.50 per month, plus $10 per employee per month.

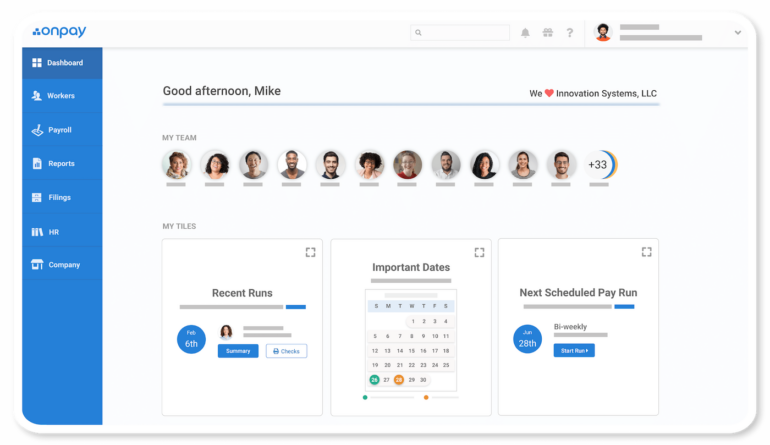

OnPay: Best for very small businesses

OnPay is a cloud-based, full-service payroll processing system designed to help small business owners quickly and accurately manage payroll at an affordable price. It offers an intuitive interface with various features such as pay stubs, direct deposits, tax filing and time tracking.

As one of the best payroll software for small businesses, Onpay also provides compliance support, so employers can be confident they’re meeting all applicable laws (Many payroll solutions only include compliance alerts with their most expensive plans.). OnPay supports a variety of payment methods, including ACH and prepaid debit cards. It also offers integrations with various third-party services, such as QuickBooks and Xero.

Key features

- Employee management

- Health insurance and retirement benefits management

- Unlimited monthly pay runs

- Automated tax payments and filings

- Free W-2 and 1099 processing

Pros

- Affordable

- Available in all 50 states in the U.S.

- Automated tax payments and filings

- No add-on fees

Cons

- No live customer support available on weekends

- No mobile app

Pricing

OnPay’s small business payroll solution has a straightforward, simplified pricing structure: It costs a monthly base fee of $40 plus $6 per employee per month.

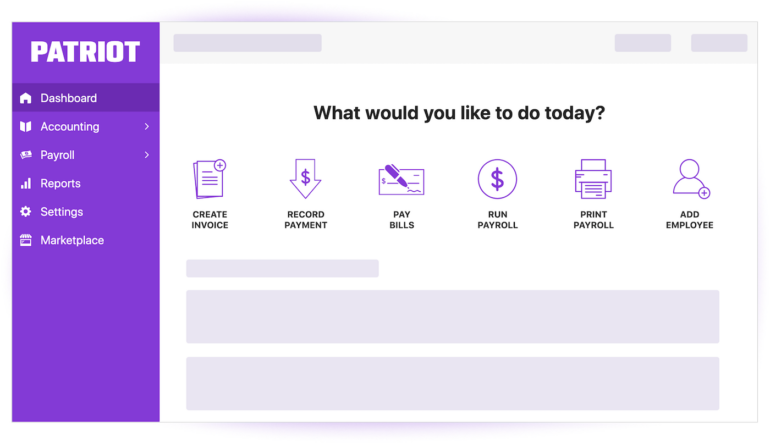

Patriot Software: Best for simplicity

Patriot Payroll is a full-service payroll processing option designed to be affordable for small-business owners. It provides a comprehensive suite of services to make it easier for you to manage your payroll and comply with federal, state and local tax laws.

Patriot Software’s small business payroll processing services skip frills and flourishes of other payroll vendors. If all you want is a vendor to run payroll and file the appropriate payroll and income taxes, Patriot Software may be the most straightforward option on the market.

Patriot also offers a self-service payroll processing solution with a lower starting price. Businesses can use the software to calculate payroll numbers and deposit checks, but you’ll remit payroll taxes yourself instead of turning the task over to Patriot.

Key features

- Free expert support

- Pay different groups of employees weekly, biweekly, semi-monthly or monthly as needed

- Bookkeeping integration included

- Automatic filing for all payroll taxes (full-service payroll plan only)

- Direct deposit

- 30-day trial period

- Unlimited payroll runs

- Web/mobile interface

Pros

- Offers a 30-day free trial

- Affordable

- Comprehensive knowledge-base resources

- Self-service employee portals

- Intuitive user interface

Cons

- HR service costs extra

- Time and attendance incur an additional fee

Pricing

The service offers a free 30-day trial period and two pricing plans:

- Full-service payroll: Can be purchased for $37 per month plus $4 per employee or contractor.

- Basic payroll: Costs $17 per month plus $4 per employee or contractor.

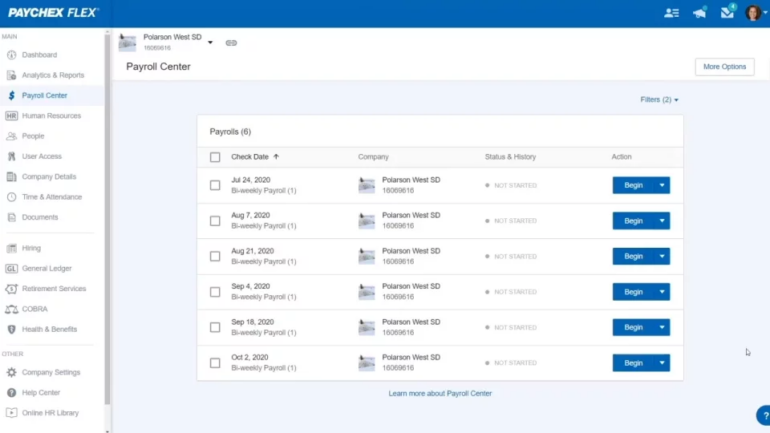

Paychex: Best for growing businesses

Paychex is a human-capital services company that specializes in payroll, employee benefits and other human resources functions. Paychex handles payroll processing, tax filing and other compliance services, and it provides business insurance to small and medium-sized businesses.

Paychex offers various payroll features and services, including a mobile app, integrated HR services and workers’ compensation reporting. Businesses that want a more thorough solution than a cloud-based online payroll services and HR software solution can use Paychex’s PEO services, which compare favorably to ADP’s.

Key features

- New-hire reporting to government agencies

- HR analytics and events calendar

- Bookkeeping integration included

- Employee benefits management included

- Automatic filing for all payroll taxes

- Time tracking included

Pros

- Offers professional employer organization capabilities

- Automates payroll tax filing

- Feature-rich

- 24/7 chat and phone support

- Employee self-service functions

Cons

- Can be pricey for smaller teams

- Slow responses from support

- Steep learning curve

Pricing

- Paychex Flex Essentials: $39 per month plus $5 per employee.

- Paychex Flex Select: Pricing information is available upon request.

- Paychex Flex Pro: Pricing information is available upon request.

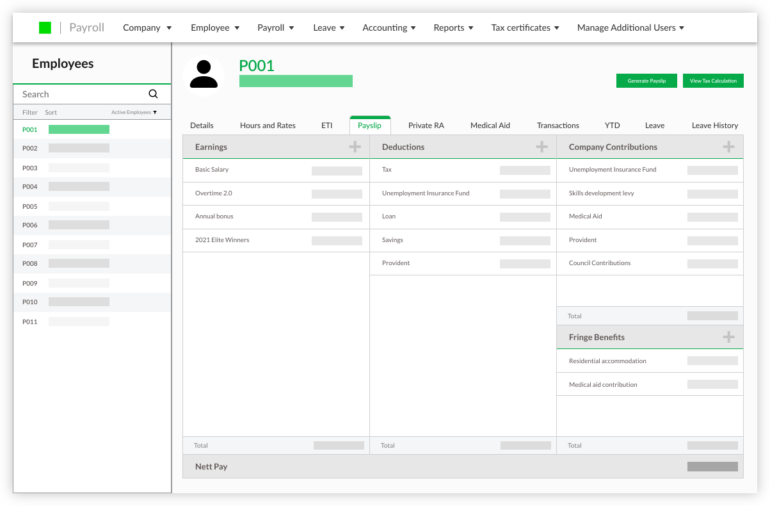

Sage HRMS Payroll: Best for HR services

Sage HRMS Payroll is part of a wholly integrated HR management and accounting software system from Sage Group PLC. This payroll service is most effective when your business uses other Sage products and services in its business management portfolio. The payroll software is fully integrated with Sage HRMS, so companies can manage payroll and employee data in one place.

Key features

- Bookkeeping integration included

- Employee benefits integration

- Manual payroll tax filing

- Unlimited processing

Pros

- Employee benefits management

- Benefits accrual tracking and reporting

- New-hire reporting

Cons

- Lacks transparent pricing

- Users report performance issues

Pricing

Pricing information is available upon request from the Sage sales team.

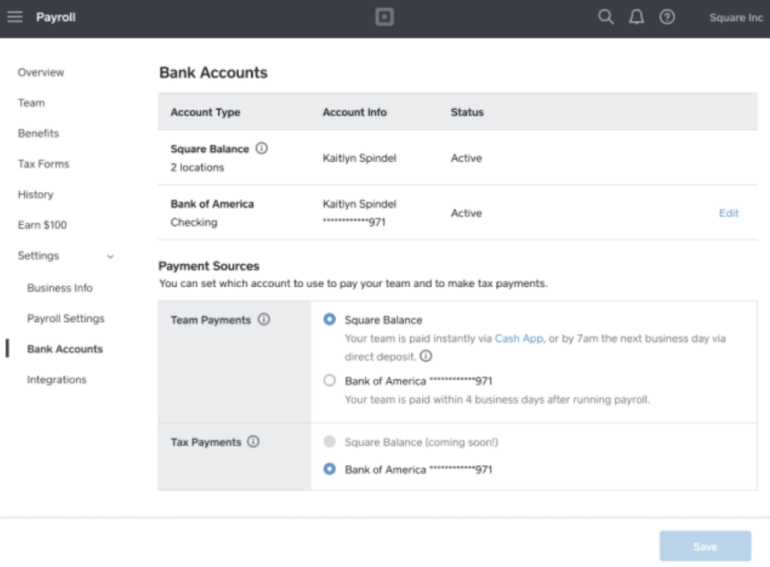

Square Payroll: Best for retailers and contractor-only businesses

The Square Payroll Processing Service is an affordable, easy-to-use payroll solution for small businesses. It is handy for businesses that rely on contractors and hourly employees. With Square Payroll, companies can send employees their paychecks, manage scheduling and time-tracking, withhold and file taxes, and administer benefits such as health insurance and retirement savings.

Key features

- Integrations with Square products

- Automatic filing for all payroll taxes

- Direct deposit

- Payroll for employees and contractors

- Unlimited processing

- Web/mobile interface

Pros

- Contractors-only option

- Multi-state payroll — available in all 50 states

- Unlimited pay runs per month

Cons

- Only basic reporting features

- Email-only support

Pricing

Square offers two pricing plans:

- Employees and contractors: $35 monthly base fee plus $5 per employee or contractor.

- Contractors only: $5 per contractor per month.

What features should you look for in payroll services?

As you search for the best payroll company for you, consider your company’s payroll needs in the following key areas.

Security and privacy

Look for payroll companies that encrypt all data, store it securely and follow all applicable privacy regulations. You’ll also want to look for a payroll company with built-in accuracy checks to ensure all calculations and filings are correct.

Ease of use

Look for services that are easy to use and come with helpful tutorials and user-friendly dashboards. Make sure to consider automated payroll processes and look for payroll solutions that can automate the most time-consuming tasks, such as calculating employee wages, preparing direct deposits, data entry and tax filing.

Employee self-service

Employees should be able to access their payroll information online from anywhere. It’s essential for payroll services to provide user-friendly self-service tools that allow employees to view their hours worked, pay stubs and other information.

Reporting

Payroll solutions should provide detailed reports on employee earnings statements, payroll summaries and year-end tax forms. Reports should also be customizable so you can track wage and hour data, employee hours worked and other important information as needed.

Scalability

Your payroll service should handle your current payroll needs and grow with your business. Look for features such as multiple employee profiles and the ability to add or delete employees as needed.

How do I choose the best payroll processing service for my business?

The right payroll service for another business might not be the right one for yours. To figure out which payroll company will work best for your business, consider the payroll features we listed above and assess your unique needs by asking questions like the following:

How much time are you willing to spend running payroll?

Managing payroll through a payroll service can significantly reduce the administrative burden of running payroll, but each payroll provider offers a different level of administrative streamlining. Self-service payroll plans, such as those from Patriot Payroll or SurePayroll, leave tax filing up to you, which means payroll will consume more of your time. In contrast, full-service plans from Gusto and Paychex let you set payroll runs to autopilot so you don’t have to dedicate much, if any, time or attention to your payroll runs.

Do you need employee benefits administration?

Most small businesses with full-time in-house employees are required to offer certain benefits. Many payroll services assist with administering benefits such as health insurance and retirement plans, which can help ensure that employee benefits are appropriately managed and that all necessary paperwork is filed promptly. However, if you only pay contractors and freelancers, you don’t need a plan with benefits administration.

What can you afford?

Outsourcing payroll to a professional provider can save small businesses money by reducing payroll processing costs and eliminating the need to hire additional staff for this task. But the amount of money you can save depends in large part on how much your small-business payroll software costs. Plans for paying contractors start at just $4 or $5 per contractor per month, while plans that include benefits administration usually start around $30 to $40 a month plus an additional fee per employee.

Methodology

To assess and rank the best payroll processing services for small businesses, we thoroughly researched the most popular and best-ranked software in the industry. We read customer reviews on third-party review sites like Trustpilot, test-drove software whenever we could, and extensively explored demos and information on each software company’s website.