Paylocity is a full-service payroll and human resources platform. It’s suitable for small, midsized and large businesses. Continue reading to learn if Paylocity is the right tool for your business.

Paylocity's fast facts [4.1 stars]Pricing: Paylocity pricing is available upon request Key features:

|

Jump to:

- What is Paylocity?

- Pricing

- Key features of Paylocity

- Pros and Cons of Paylocity

- If Paylocity isn’t ideal for you, check out these alternatives

- Who is Paylocity best for?

- Review methodology

What is Paylocity?

Paylocity is a cloud-based payroll and HR information system platform. It’s best suited for midsized and large companies that want to automate their HR and payroll tasks. Paylocity currently serves over 33,000 clients and has over 2,000 partners. Paylocity also offers small businesses payroll services and supports companies with global workforces. Paylocity is also one of our top-rated payroll software services for 1-employee businesses.

Paylocity is used in various industries, including:

- Restaurant and hospitality.

- Manufacturing.

- Retail and wholesale.

- Nonprofit.

- Financial services.

- Healthcare.

- Tech and professional services.

- Education.

If your company is looking to manage both payroll and HR on one platform without switching between tools, then Paylocity is worth considering. We also analyzed top Paylocity alternatives should it not fit your organization.

SEE: If you’re a fan of acronyms, it might be worth checking out the best PEO companies of 2023.

Pricing

Paylocity is a quote-based tool. Intending customers are required to fill out the demo and pricing request form on Paylocity’s website to get a custom quote. Note that Paylocity is priced per employee per month, and your actual rate depends on the number of employees in your organization and your selected features.

Key features of Paylocity

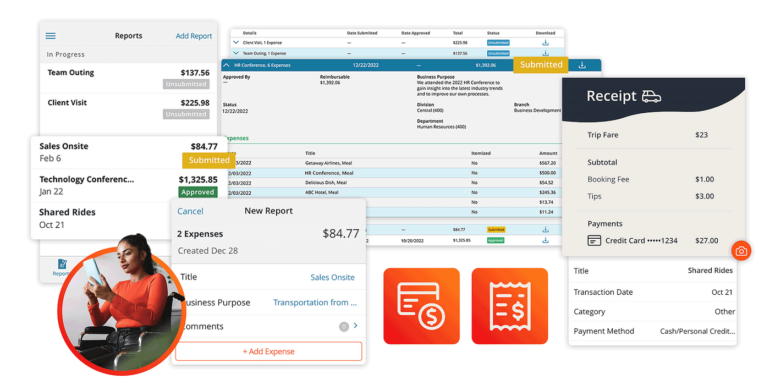

Expenses management

The manual way of managing expenses involves utilizing calculators and spreadsheets to compute employees’ payments — managers then append their signatures before the payroll can be processed — not only is the method time-consuming, but it also increases the likelihood of errors.

Paylocity makes it easy to expedite reimbursement and improve compliance with its expense management capability. Organizations can digitize submitting, approving and reimbursing employee expenses. Employees can upload and track their receipts on Paylocity, while supervisors can review and approve the payments. This significantly reduces the amount of time employees and managers spend on expense reports.

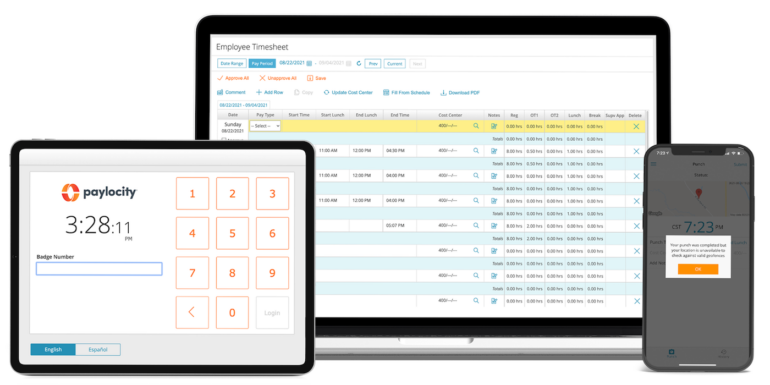

Time and attendance tracking

Paylocity’s time and attendance module allows managers to set up and track employee schedules, approve or deny time-off requests, manage overtime and breaks, and generate reports to analyze employee attendance patterns. These benefit organizations that pay per hour or project, enabling managers to check and track employee hours on the job. Paylocity allows employees to clock in and out via their mobile devices — they also offer clock-in based on geolocation, which makes it suitable for remote field workers who need to track worksites.

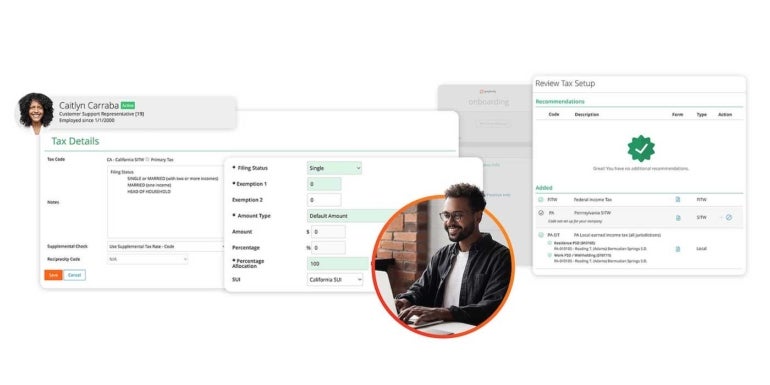

Payroll tax support

Individuals or businesses with reportable taxable income are mandated by U.S. law to file tax returns. As a registered reporting agent with the IRS in all 50 U.S. states, as well as Puerto Rico, the Virgin Islands and Guam, Paylocity helps organizations prepare and file the following taxes:

- State and local withholding tax returns.

- Federal and state unemployment tax returns.

- 940 federal unemployment returns and 941 quarterly returns.

- All W-2s and files with the Social Security Administration.

- State and local annual reconciliation.

- Provide and file 1099-MISC forms (employee and employer copies).

This helps you meet filing deadlines, deposit requirements and payment due dates.

Employee self-service

Paylocity’s self-service portal enables employees to manage their payroll needs, such as payments, tax statements, expense tracking and HR, such as time-off requests, clock in and out and updates. Premium users’ employee self-service portal includes additional features such as a learning management system and on-demand payment and social collaboration hub, which includes community forums, chat and peer recognition.

Customer support

Paylocity offers multiple support channels for customers to get help. They offer two categories of support: Self-service support and live support. For the former, users can watch videos and tutorials, access the knowledge base or help center or read the company blog. Paylocity also offers live chat, email, social media and phone support Monday through Friday. They can even provide your company with dedicated account managers.

With these multiple support channels, you’d expect Paylocity to have a stellar customer satisfaction record; a look at user reviews on sites like Gartner shows that the company needs to improve its customer service. Even though Better Business Bureau gave Paylocity an A+ rating, the company averaged one star based on 21 customer reviews.

Paylocity integration

Integrations can help companies scale their operations quickly and easily by integrating with new platforms or services as needed. Paylocity offers over 340 third-party integrations via its marketplace, including Intuit QuickBooks Online, Expensify, Clover, Oracle NetSuite and Xero.

Pros and Cons of Paylocity

Pros

- Received an A+ rating from BBB.

- Extensive integrations.

- Remote employees praise Paylocity’s punch-in and out system.

- Paylocity is feature-rich.

- It’s employee friendly.

Cons

- Lacks transparent pricing.

- Paylocity doesn’t offer a free trial.

- Complex initial setup process.

If Paylocity isn’t ideal for you, check out these alternatives

Paylocity vs. Rippling vs. Paycom comparison summary table

| Paylocity | Rippling | Paycom | |

|---|---|---|---|

| Starting price | Quote-based | $8 per user per month | Quote-based |

| Free trial | No | No | No |

| Business size | Small to enterprise-sized businesses | Small to enterprise-sized businesses | Small to enterprise-sized businesses |

| Global payroll | Yes | Yes | No |

| Garnishment administration | Yes | Yes | Yes |

| U.S. states availability | All 50 states | All 50 states | All 50 states |

| Tax filing and payment | Yes | Yes | Yes |

| Time attendance | Yes | Yes | Yes |

| Training and learning | Yes | Yes | Yes |

| Mobile app | Yes | Yes | Yes |

Rippling

Rippling is a cloud-based payroll, HR and IT management platform designed to automate employee data and system access across an organization. It’s an all-in-one platform that integrates HR, payroll and IT management functions. This means that businesses can manage employee data, payroll and benefits, as well as monitor and manage IT system access and activity, all from one centralized dashboard. Meanwhile, Paylocity primarily focuses on HR and payroll management and doesn’t offer the same IT management features.

Paycom

Paycom is a full-service human capital management and payroll software designed for various professionals, including CEOs and owners, finance executives, HR managers, IT decision-makers, operations executives and payroll managers. Like Paylocity, Paycom also offers a quote-based pricing model. Paycom features an employee self-service payroll option, called Beti, which allows employees to access their payroll documents and guide them to resolve errors without going through a manager — a plus for organizations looking for a flexible payroll tool that doesn’t overburden managers.

Who is Paylocity best for?

The best payroll software for you depends on your needs and organization’s use cases. Paylocity is best for scalable midsized to large businesses looking for an all-in-one tool to manage payroll and HR needs. It can help these businesses manage their HR functions, including payroll processing, benefits administration and time and attendance tracking.

On the other hand, small businesses with less than 20 employees may find Paylocity too expensive due to its pricing module. Consider your business needs before making a purchase decision.

Review methodology

We collected product data directly from the Paylocity website, including information on pricing plans, features, and targeted customers. In addition to our primary research, we also gathered user experience data from third-party review websites like Gartner, BBB and other resources.