Wave Payroll is an effective and solid payroll solution for small businesses. The platform includes many great tools and is easy for new subscribers to learn. Wave Payroll is only a small part of the suite of applications offered by Wave, which include accounting, invoicing and payments software as well.

SEE: Trying to find the best payroll software for your business? This list can help.

In 2023, Wave Payroll is certainly viable for small businesses. If you operate a small business, work extensively with independent contractors, or are looking for new payroll software, Wave Payroll might be for you.

Wave Payroll’s fast factsPricing: Starts at $20 per month plus $6 per employee. Key features:

|

Jump to:

- Pricing

- Key features of Wave Payroll

- Wave Payroll pros

- Wave Payroll cons

- Alternatives to Wave Payroll

- Should our organization use Wave Payroll?

- Review methodology

Pricing

Wave Payroll pricing is relatively straightforward. There are two payroll packages; you can subscribe to the self-service tax filing plan or the assisted service plan. Wave offers these packages because of tax laws in the United States.

In 14 U.S. states, you can choose to have your taxes automatically filed. If you are in one such state (Arizona, California, Florida, Georgia, Illinois, Indiana, Minnesota, New York, North Carolina, Tennessee, Texas, Virginia, Washington and Wisconsin), you may want to utilize Wave’s Tax Service States plan. If your business operates in other locations, however, you can opt for Wave’s cheaper package.

The prices of the two plans are as follows:

- Tax Service States: $40 per month plus $6 per employee/independent contractor.

- Self Service States: $20 per month plus $6 per employee/independent contractor.

- 30-day Free Payroll available after you submit your first payroll.

Key features of Wave Payroll

Payroll

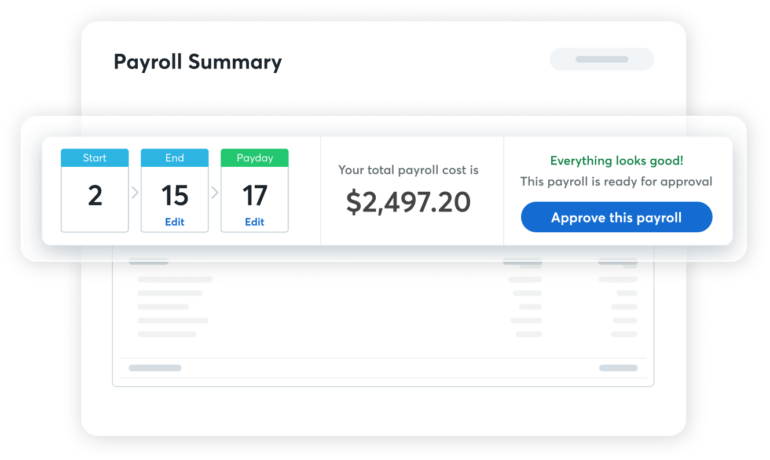

In order for a payroll service to be successful, its basic payroll tools must be good. Fortunately, you’ll find quality features included in Wave Payroll. There are a few essential tools, like direct deposit and one-click payments. But there are many other features that you can take advantage of as well.

If your enterprise is frequently working with independent contractors, they’ll be able to access an employee portal along with other team members to see their payment details. You will also be able to migrate existing payroll data to Wave’s service and meet with customer service representatives live during the work week. These tools will help you organize your small business and save you time by simplifying your payments.

Tax tools

In 14 U.S. states, as listed above, you can get access to a comprehensive tax-filing service through Wave. The platform will take care of your businesses taxes with ease. Unfortunately, you may not be eligible for that level of service. The good news is that there are other great tax tools offered by Wave Payroll. You can file taxes for independent contractors, for example, and generate W2 and 1099 documents quickly. You can also choose to hire a Wave tax advisor to help with your business’ documents, though this will mean paying additional fees.

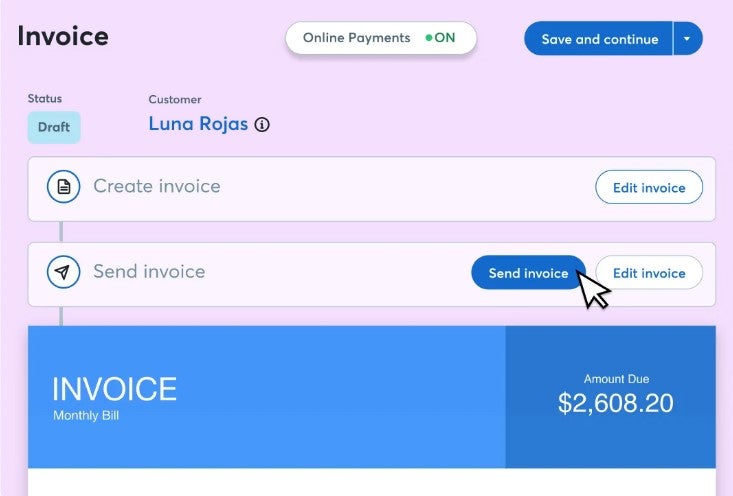

Invoicing

Wave offers some great invoicing tools. Some of these are available through Payroll, though access to all of them will require you to subscribe to Wave’s complete set of services: Payroll, Accounting, Invoicing and Payments. With invoicing tools, you’ll be able to use Wave’s security tools to ensure safe payments. The platform also guarantees invoices will be received by employees in one business week or less. For credit payments, wait time is dramatically reduced.

Analytics

The analytics tools in Wave Payroll are decent, allowing you to see basic information about your business. For example, you’ll be able to see payments per employee, as well as an overview of what type of expense you’re utilizing. You will also have access to time tracking tools. More detailed reporting, however, is not readily available.

Wave Payroll pros

- Includes comprehensive tools like direct deposit, one-click payments and time tracking.

- Affordable and simple pricing for teams.

- Employee portal makes it easy for employees to see taxes, payments and bank details.

Wave Payroll cons

- Tax filing package only available for 14 U.S. states.

- Automated tools are sparse (only available for certain features, like analytics syncing).

- No mobile app for teams to utilize.

Alternatives to Wave Payroll

If Wave Payroll isn’t sounding right for your business, there are a few others you might want to explore. Gusto and ADP are two prominent and effective payroll platforms that may be better for your enterprise.

Gusto

If you are working with a small organization but Wave Payroll doesn’t seem right for you, consider giving Gusto a try. Gusto is great for small businesses, has excellent automated tools and is reasonably priced. It might be the perfect platform for your enterprise.

Gusto’s pricing is as follows:

- Simple: $40 per month plus $6 per employee.

- Plus: $80 per month plus $12 per employee. (Six-month discount available).

- Premium: Inquire at Gusto’s site for more information.

Read our review of Gusto’s software for more details.

ADP

Wave Payroll may sound a little too tame for you. If that’s the case, you should consider ADP. ADP is better for large or growing businesses and includes some great tools that Wave doesn’t. Things like global payroll, advanced automation tools and a mobile app are bound to help your business thrive. ADP also has tools for small businesses as well, though their suite of additional HR and scalability features are best used by growing companies.

ADP has a few different pricing plans for larger brands. These are as follows (though you’ll need to inquire at ADP’s site for exact pricing):

- Essential

- Enhanced

- Premium

Read our review of ADP’s software for more details.

Should our organization use Wave Payroll?

Wave Payroll can be great for some organizations. If your small-business payroll isn’t currently robust enough for you, Wave could be the solution. Alternatively, Wave Payroll is a viable option for small businesses that don’t currently have any sophisticated payroll tools. However, larger businesses might be better off with a more capable service. If your organization does business with individuals around the world, for example, Wave Payroll likely isn’t for you. It all comes down to what you require and how important a successful payroll platform is for your business.

Review methodology

This review features information compiled from multiple relevant sources. The above information about Wave Payroll was collected from users, the vendor and reputable third-party organizations.